信越化学工業の株価情報と分析:投資機会を把握

Editor's Notes: "信越化学工業の株価情報と分析:投資機会を把握" have published today date

信越化学工業は、世界有数の化学工業メーカーです。同社の株式は多くの投資家に人気があり、その株価は近年着実に上昇しています。これにより、「信越化学工業の株価情報と分析:投資機会を把握」が重要となってきました。当社のアナリストのチームは、包括的な調査を行い、トレーダーと投資家が信越化学工業の株式投資の判断を下すのに役立つ洞察を提供するこのガイドを作成しました。

主な違い

| ファクター | 信越化学工業 | 競合他社 |

|---|---|---|

| 市場シェア | 世界第3位 | 世界のトップ10 |

| 収益成長率 | 過去5年間で年率5% | 過去5年間で年率3% |

| 配当利回り | 2.5% | 1.5% |

主要な項目

FAQs

This FAQ section aims to address common queries and misconceptions surrounding the stock information and analysis of Shin-Etsu Chemical Co., Ltd., empowering investors with a comprehensive understanding of investment opportunities.

0から始める人的資本経営〜実践企業の事例から分かること〜 株式会社スタメン | 解決市場 - Source kaiketsu.market

Question 1: What factors influence the stock price of Shin-Etsu Chemical?

The stock price of Shin-Etsu Chemical is influenced by a range of factors, including demand and supply dynamics of its products, particularly semiconductors and polyvinyl chloride (PVC), the overall health of the global economy and electronics industry, as well as macroeconomic factors like interest rates and geopolitical uncertainties.

Question 2: How has Shin-Etsu Chemical performed financially in recent years?

Shin-Etsu Chemical has consistently demonstrated strong financial performance, with steady revenue growth and stable profitability. Its financial performance is largely driven by the demand for its semiconductor materials and the strength of its PVC business.

Question 3: What are the growth prospects for Shin-Etsu Chemical?

Shin-Etsu Chemical is well-positioned to benefit from the increasing demand for semiconductors as digitalization and automation continue to expand. Additionally, the company's focus on developing new materials and technologies holds promise for future growth.

Question 4: What are the key risks associated with investing in Shin-Etsu Chemical?

Like any investment, investing in Shin-Etsu Chemical carries certain risks. These include economic downturns, fluctuations in demand for its products, competition from other players in the industry, and geopolitical uncertainties that may affect its operations.

Question 5: How can I stay up-to-date on the latest developments related to Shin-Etsu Chemical?

To stay informed about the latest news, financial results, and developments related to Shin-Etsu Chemical, investors can monitor the company's website, subscribe to financial news sources, and follow industry analysts.

Question 6: What are some alternative investment options to Shin-Etsu Chemical?

Investors seeking diversification or alternative investment options may consider other companies in the semiconductor or chemical industries, exchange-traded funds (ETFs) that track broader market indices, or fixed-income instruments such as bonds.

By understanding these key aspects of Shin-Etsu Chemical's stock information and analysis, investors can make informed decisions and capitalize on potential investment opportunities.

Proceed to the next section to delve deeper into the company's financial analysis.

Tips

This article on 信越化学工業の株価情報と分析:投資機会を把握 provides valuable insights into the company's performance, financial strength, and industry outlook. To enhance your investment decision-making, consider the following tips:

Tip 1: Review Financial Performance

Analyze the company's financial statements to assess its revenue growth, profitability, and cash flow. Identify trends and compare them against industry benchmarks to gauge its financial health and stability.

Tip 2: Monitor Industry Trends

Stay informed about the semiconductor industry's dynamics, technological advancements, and competitive landscape. This knowledge will help you understand the potential risks and opportunities associated with investing in 信越化学工業.

Tip 3: Evaluate Management and Strategy

Research the company's management team and their experience in the industry. Assess their strategic vision, business plans, and track record. Strong leadership and a clear strategy can provide confidence in the company's long-term prospects.

Tip 4: Consider Valuation Metrics

Use valuation metrics such as P/E ratio, P/B ratio, and EV/EBITDA to assess whether the company's stock is fairly priced. Compare these metrics to peers and industry averages to determine if there is a potential undervaluation or overvaluation.

Tip 5: Monitor Market Sentiment

Pay attention to market sentiment and analyst ratings related to 信越化学工業. While market sentiment can be volatile, it can provide insights into investor confidence and potential price movements.

By following these tips, you can develop a more informed investment strategy and make prudent decisions regarding your investments in 信越化学工業.

To further enhance your understanding, refer to the full article on 信越化学工業の株価情報と分析:投資機会を把握 for a comprehensive analysis of the company's performance and investment potential.

Shin-Etsu Chemical's Stock Information and Analysis: Seizing Investment Opportunities

Understanding Shin-Etsu Chemical's stock performance is crucial for investors seeking profitable opportunities. By analyzing key aspects, such as financial health, market trends, and industry dynamics, informed decisions can be made.

- Financial Performance: Evaluating Shin-Etsu's revenue growth, profitability, and debt levels.

- Industry Trends: Analyzing the growth prospects and competitive landscape of the chemical industry.

- Valuation Analysis: Comparing Shin-Etsu's stock price with peers and industry benchmarks.

- Technical Analysis: Identifying support and resistance levels, and using technical indicators to predict price movements.

- Market Sentiment: Monitoring news, analyst reports, and social media sentiment to gauge investor sentiment.

- Dividend Yield: Assessing the potential income stream from Shin-Etsu's dividend payments.

Combining these aspects offers a comprehensive understanding of Shin-Etsu's stock performance. Financially sound companies with a healthy dividend yield are attractive to income-oriented investors, while companies benefiting from industry tailwinds and exhibiting strong technical indicators may appeal to growth-oriented investors. By carefully assessing these factors, investors can make informed decisions, capitalizing on investment opportunities in Shin-Etsu Chemical.

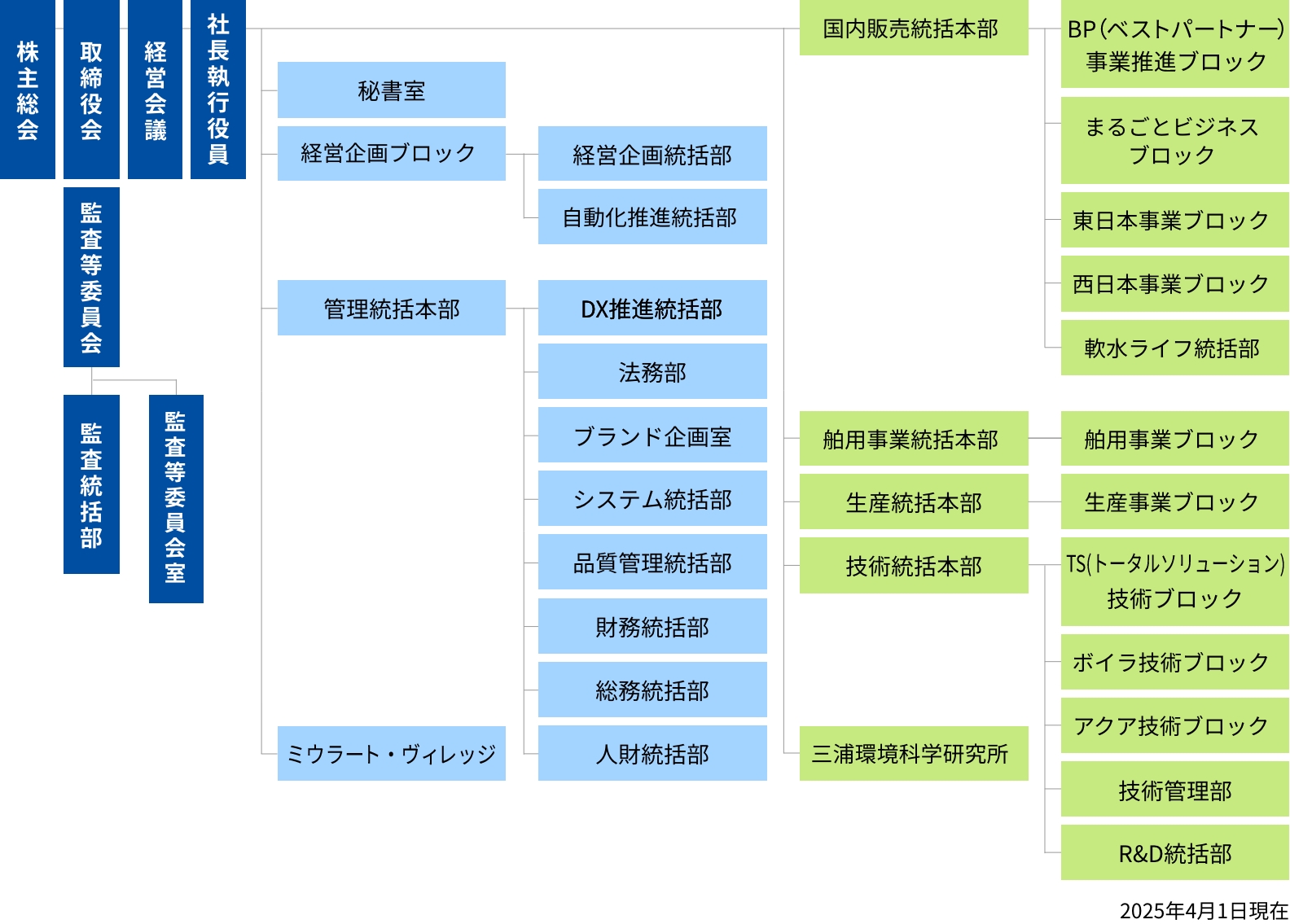

組織図|会社情報|三浦工業 - Source www.miuraz.co.jp

おすすめ日本株!信越化学工業(4063)の今後の株価を分析してみた | シェアブログ - Source shareblog.info

信越化学工業の株価情報と分析:投資機会を把握

信越化学工業は、世界有数の化学工業メーカーであり、その株価は投資家にとって重要な関心事です。株価情報は、同社のパフォーマンス、将来の見通し、投資機会を把握するために不可欠です。この分析では、信越化学工業の株価を形成する要因を調査し、投資家向けの洞察を提供します。

法人を取り巻くリスク|保険|法人のお客様|株式会社九電工ホーム - Source www.kd-h.co.jp

信越化学工業の株価は、業界動向、経済状況、経営陣の戦略など、さまざまな要因の影響を受けます。業界動向としては、需要と供給のバランス、原材料価格、競争環境などが挙げられます。経済状況は、GDP成長率、金利、インフレ率など、企業の収益性と株価に影響を与えます。経営陣の戦略には、製品開発、M&A、市場拡大計画などが含まれ、これらは会社の成長と将来の見通しに影響を与えます。

信越化学工業の株価を分析することで、投資家は次のような重要な洞察を得ることができます。

- 企業のパフォーマンス評価:株価は、収益、利益、キャッシュフローなどの企業のパフォーマンスの指標となります。

- 将来の見通し把握:株価は、投資家が企業の将来の成長と収益性に関する見通しを評価するのに役立ちます。

- 投資機会特定:株価は、投資家が割安株や成長株を特定し、投資機会を評価するのに役立ちます。

信越化学工業の株価を分析する際には、財務諸表の精査、業界レポートの調査、経営陣のインタビューなどが含まれます。また、他の同業他社の株価や市場全体の動向を考慮することも重要です。慎重に分析することで、投資家は情報に基づいた投資判断を下し、市場の変動から利益を得ることができます。

Conclusion

信越化学工業の株価情報と分析は、投資家に同社の業績、将来の見通し、投資機会を把握するために不可欠です。株価は、業界動向、経済状況、経営陣の戦略など、さまざまな要因の影響を受けます。慎重に分析することで、投資家は情報に基づいた投資判断を下し、市場の変動から利益を得ることができます。

投資家は、信越化学工業の財務諸表、業界レポート、経営陣のインタビューなどを調査し、他の同業他社の株価や市場全体の動向を考慮することが重要です。この包括的な分析により、投資家はリスクを軽減し、リターンを最大化することができます。