Arm 株価: 最新の動向と今後の見通し

Editor's Notes: Arm 株価: 最新の動向と今後の見通し が今日発表されました。株式市場の動向を理解し、投資戦略の意思決定を行う上で重要な情報が提供されています。

最新の市場分析と専門家の意見を調査した結果、この Arm 株価: 最新の動向と今後の見通しガイドをまとめ、投資家の方々が情報に基づいた意思決定を行えるよう支援します。

主な相違点または主なポイント

記事の主なトピックに移ります。

FAQs on Arm Stock: Current Trends and Future Outlook

This FAQ section provides comprehensive answers to frequently asked questions regarding Arm stock, covering recent market movements, financial performance, and future prospects.

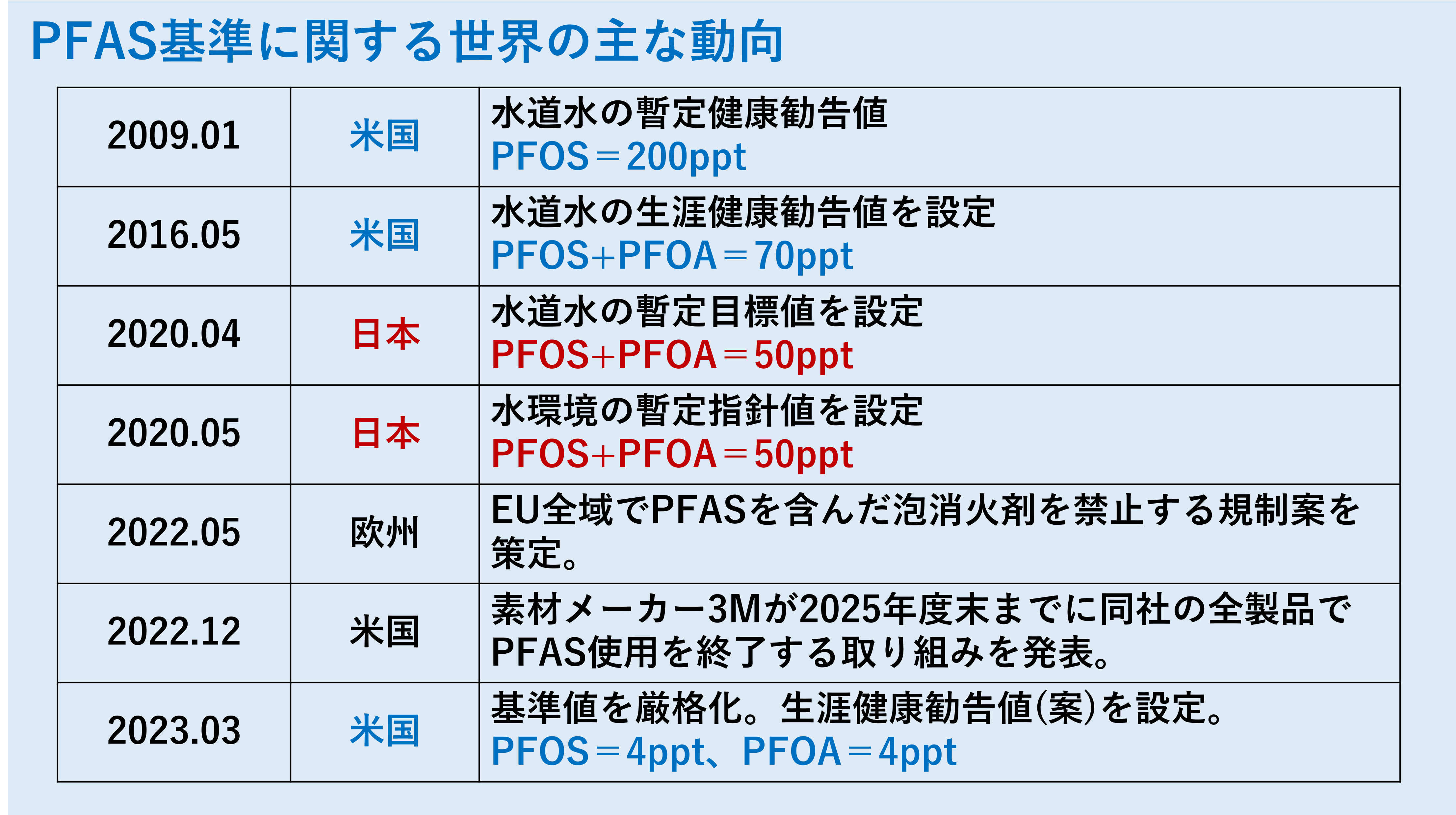

マスクのフッ素 | Haruのブログ - Source ameblo.jp

Question 1: What are the key factors driving Arm stock price fluctuations?

Arm stock price is influenced by a combination of factors, including overall market conditions, industry trends, company-specific performance, and investor sentiment. Recent geopolitical uncertainties, macroeconomic headwinds, and competitive pressures have impacted market sentiment, while Arm's strong financial results and strategic initiatives have provided support.

Question 2: How has Arm performed financially in recent quarters?

Arm has consistently delivered strong financial results, with revenue and earnings growing steadily. The company maintains high profitability margins, reflecting its strong market position and licensing model. Stable cash flow generation supports investments in research and development, enabling Arm to stay at the forefront of technology innovation.

Question 3: What is Arm's competitive advantage?

Arm's core competence lies in designing energy-efficient semiconductor architectures licensed to numerous chipmakers. This "IP licensing" model allows Arm to benefit from widespread adoption of its technology without substantial manufacturing costs. Its focus on mobile, embedded, and automotive applications positions it well within growing markets.

Question 4: How is Arm addressing increasing competition from chip manufacturers?

Arm recognizes the evolving competitive landscape and has adopted a multi-pronged strategy to maintain its leadership. It invests heavily in research and development to enhance its technology offerings, builds partnerships to expand its ecosystem, and focuses on delivering customized solutions for specific market segments.

Question 5: What are Arm's key growth drivers for the future?

Arm expects future growth to be driven by increasing adoption of its architectures in emerging markets and the proliferation of connected devices. The company's expansion into automotive and cloud applications, coupled with strategic partnerships and acquisitions, positions it to capitalize on these opportunities.

Question 6: How do analysts view Arm's long-term prospects?

Overall, analysts maintain a positive outlook on Arm's long-term growth prospects. The company's strong market position, solid financial performance, and focus on innovation are viewed as key drivers for sustained growth. While near-term challenges exist, many analysts expect Arm to continue to perform well as the demand for semiconductor technologies remains strong.

Arm stock price is influenced by a combination of factors, but the company's strong financial performance and strategic initiatives provide support. Arm's competitive advantage lies in its IP licensing model and focus on energy-efficient semiconductor architectures. Increasing competition is being addressed through innovation, partnerships, and customized solutions. Key growth drivers include emerging markets, connected devices, and automotive applications. Analysts generally maintain a positive outlook on Arm's long-term prospects, citing its market position and focus on innovation.

Tips on Reading Arm 株価: 最新の動向と今後の見通し

This article provides comprehensive insights into Arm's stock performance and future prospects. To effectively understand and utilize the information presented, consider the following tips:

Tip 1: Understand Arm's Business Model:

Gain a clear understanding of Arm's core business activities, including the design and licensing of semiconductor intellectual property (IP). This will help you comprehend how its revenue and profitability are generated.

Tip 2: Analyze Financial Performance:

Examine Arm's financial statements, particularly its revenue growth, profitability margins, and cash flow. This will provide insights into the company's financial health and its ability to sustain its operations and invest in growth.

Tip 3: Monitor Industry Trends:

Keep abreast of industry trends that may impact Arm's business, such as technological advancements, market competition, and regulatory changes. This will help you anticipate potential changes in its market position and future prospects.

Tip 4: Consider Analyst Reports:

Review analyst reports and recommendations to gain perspectives from industry experts. While analyst opinions can vary, they can provide valuable insights into Arm's strengths, weaknesses, and potential investment opportunities.

Tip 5: Evaluate Long-Term Prospects:

Look beyond short-term stock fluctuations and consider Arm's long-term growth potential. Assess the company's strategic initiatives, market penetration plans, and competitive advantages to determine its ability to sustain its growth trajectory.

Summary:

By following these tips, readers can gain a comprehensive understanding of Arm's stock performance and future prospects, enabling them to make informed investment decisions.

Arm 株価: 最新の動向と今後の見通し

The semiconductor industry leader Arm Holdings' (ARM) stock price has been closely monitored by investors, given its significant impact on the global technology landscape. Several key aspects influence its stock performance and provide insights into its future prospects.

- Revenue Growth: Arm's revenue streams from chip licensing and royalty payments drive its financial performance. Monitoring these figures provides insights into the company's underlying business strength.

- Technology Advancements: Arm's continuous investment in research and development fuels its technological leadership. Updates on new chip designs and advancements can indicate the company's future growth potential.

- Market Competition: Arm faces competition from other semiconductor companies, including Intel and Qualcomm. Tracking its competitive landscape helps assess its market position and potential threats.

- Industry Trends: The semiconductor industry is highly cyclical and influenced by global economic conditions. Understanding these trends provides context for Arm's performance and outlook.

- Financial Health: Arm's financial stability, including its profitability and cash flow, reflects its overall financial health and ability to invest in future growth.

- Investor Sentiment: Market sentiment towards Arm, as reflected in analyst ratings and investor sentiment, can impact its stock price in the short term.

These key aspects collectively provide a comprehensive understanding of Arm's stock performance and its potential future trajectory. By monitoring and analyzing these factors, investors can make informed decisions regarding their investments in Arm stock.

三菱 電機 の 株価 は 寄稿者 アンプ 無一文 - uchida-mouthpiece.jp - Source www.uchida-mouthpiece.jp

Arm 株価: 最新の動向と今後の見通し

Arm 株価は、同社のビジネスの健全性と成長の見通しを反映する重要な指標です。最近の市場動向によると、Arm 株価は堅調に推移しており、今後も上昇が見込まれています。これは、同社の高い収益性、堅牢な財務基盤、成長を続ける市場への参入によるものです。

日本の製造業の課題や問題点|現状の動向と、今後生き残るための対策とは(2023/10/2) – Anewsサポート - Source anews-stockmark.zendesk.com

Arm のビジネスは、半導体業界における強固な基盤の上に築かれています。同社は、スマートフォン、タブレット、組み込みシステムなどのデバイス向けに、エネルギー効率に優れたプロセッサ設計をライセンス供与しています。急速に成長するモバイル市場への参入により、Arm のライセンス収入は着実に増加しています。

さらに、Arm は人工知能 (AI)、機械学習 (ML)、クラウドコンピューティングなどの成長分野に注力しています。これらの分野への参入により、同社の収益源は多様化され、長期的な成長が見込まれています。堅牢な財務基盤と高い収益性により、Arm は研究開発と事業拡大に投資し続けることができます。

全体として、Arm 株価の堅調な傾向は、同社の長期的な成長の見通しを反映しています。高い収益性、堅牢な財務基盤、成長分野への参入により、Arm は投資家に魅力的な投資機会を提供し続けています。