Understanding Inflation: Causes And Consequences In The Modern Economy - Currency's downfall or the reason to the rise in overall price level, know the potential causes and consequences of the value going down regarding inflation in today's economy.

Editor's Notes: Understanding Inflation: Causes And Consequences In The Modern Economy have published today June 27th, 2023. This topic is important to read, as inflation is a complex economic phenomenon that can have a significant impact on businesses and individuals' financial well-being. By understanding the causes and consequences of inflation, you can make more informed decisions that can help you mitigate its impact when inflation occurs in any country.

After doing some analysis, digging information, and made Understanding Inflation: Causes And Consequences In The Modern Economy, we put together this Understanding Inflation: Causes And Consequences In The Modern Economy guide to help target audience make the right decision when inflation occurs.

FAQ

This FAQ section provides answers to common questions and addresses potential misconceptions regarding inflation in the modern economy.

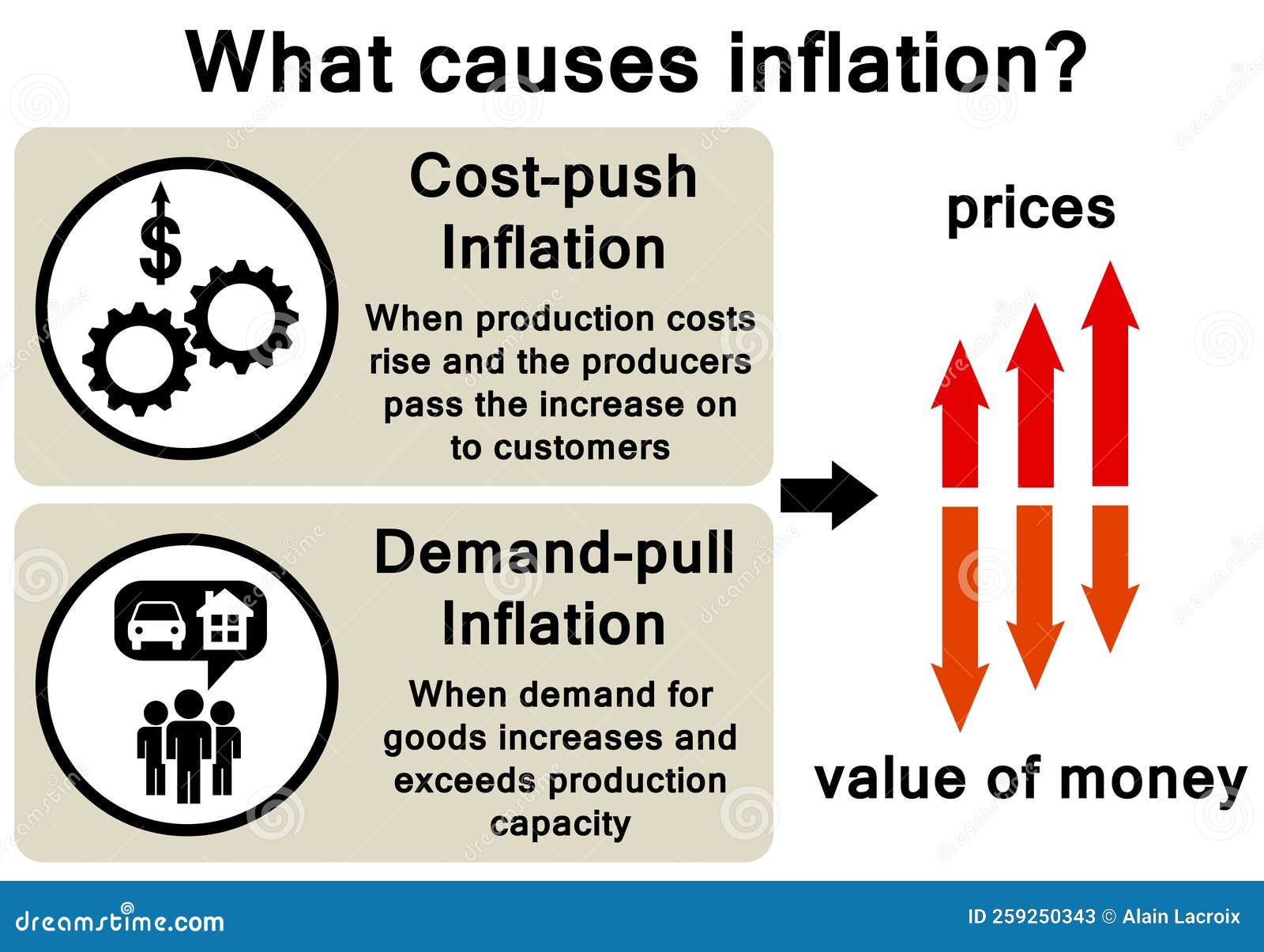

Question 1: What are the primary causes of inflation?

Inflation is a multifaceted phenomenon with various contributing factors. Factors contributing to inflation include rising production costs, increased demand in relation to supply, and monetary policy that increases the money supply.

Question 2: How does inflation impact the economy?

Inflation can have complex macroeconomic effects. It can erode the purchasing power of consumers, reduce the value of savings, and distort investment decisions. However, moderate levels of inflation can sometimes stimulate economic growth and reduce unemployment.

Question 3: What measures can governments and central banks take to control inflation?

Governments and central banks employ various strategies to curb inflation. Fiscal measures may involve reducing government spending or increasing taxes. Monetary policies often entail raising interest rates or tightening the money supply to reduce demand.

Question 4: Can inflation be beneficial in some cases?

In limited circumstances, mild inflation can foster economic growth by encouraging investment and consumption. However, prolonged or excessive inflation typically leads to negative consequences.

Question 5: How can individuals protect themselves from the effects of inflation?

Individuals can implement strategies to minimize the impact of inflation on their financial well-being. These include investing in inflation-linked assets, diversifying portfolios, and considering variable-rate debt instruments.

Question 6: What are some common misconceptions about inflation?

One common misconception is that inflation only affects the poor and unemployed. In reality, inflation can impact individuals across economic strata.

In conclusion, understanding the causes and consequences of inflation is crucial for policymakers and individuals alike. By addressing common concerns and addressing misconceptions, this FAQ section provides a valuable resource for navigating the complexities of inflation in the modern economy.

Understanding Inflation: Causes And Consequences In The Modern Economy

Tips

Understanding inflation is crucial for individuals and economies to navigate the complex financial landscape. TIPS (Treasury Inflation-Protected Securities) are a financial instrument designed to shield against inflation's eroding effects. Here are some tips to harness TIPS' potential:

Tip 1: Recognize inflation's impact on purchasing power.

Inflation reduces the value of money over time, eroding the purchasing power of individuals and businesses.

Understanding Inflation: Causes And Consequences In The Modern Economy

Tip 2: Consider TIPS for inflation protection.

TIPS adjust their principal value based on inflation, safeguarding against purchasing power loss. They can be a valuable addition to a diversified portfolio, acting as a hedge against inflation.

Tip 3: Understand TIPS' mechanics.

TIPS are issued with a fixed real (inflation-adjusted) interest rate. Their principal value fluctuates with the Consumer Price Index (CPI), offering inflation protection.

Tip 4: Assess TIPS' liquidity.

TIPS are typically less liquid than other Treasury securities. Consider this when selecting TIPS for your portfolio.

Tip 5: Consult financial professionals.

Seek advice from financial advisors to determine if TIPS align with your investment goals and risk tolerance. They can provide personalized guidance based on your financial situation.

In conclusion, TIPS offer a valuable shield against inflation. By utilizing these tips, individuals and economies can harness TIPS' potential to preserve purchasing power and navigate the challenges of an inflationary environment.

Understanding Inflation: Causes And Consequences In The Modern Economy

Inflation, a persistent rise in the general price level, is a complex phenomenon influenced by various factors. It has significant consequences for individuals and economies alike.

- Causes: Excess money supply, rising costs, demand-pull pressure

- Consequences: Eroded purchasing power, increased interest rates, economic growth slowdown

- Measurement: Consumer Price Index (CPI), Producer Price Index (PPI)

- Targeting: Central banks set inflation targets to control price increases

- Control: Monetary policy, fiscal policy, supply-side policies

- Effects on Income: Inflation can both increase and decrease disposable income depending on wage growth

Understanding the interplay of these aspects is crucial for economic policymakers and individuals alike. For instance, excessive inflation can erode the value of savings and investments, while moderate inflation may support economic growth. Moreover, demand-pull inflation, caused by increased spending, can lead to higher interest rates, impacting borrowing and investment decisions.

Understanding Inflation - Spot Your Worth - Source spotyourworth.com

Understanding Inflation: Causes And Consequences In The Modern Economy

Inflation, the persistent rise in general price levels over time, is a complex economic phenomenon that has significant consequences for individuals, businesses, and the overall health of the economy.

Inflation causes stock illustration. Illustration of government - 259250343 - Source www.dreamstime.com

One of the primary causes of inflation is an increase in the money supply relative to the supply of goods and services. This can occur when a government prints more money to finance spending or when banks lend out more money than they have on hand. When there is more money chasing a limited number of goods, prices tend to rise.

Another factor that can contribute to inflation is an increase in demand for goods and services. This can happen when the economy is growing rapidly and consumers are spending more money. When demand exceeds supply, businesses can raise prices and still sell their products.

Inflation can have a number of negative consequences for the economy, including:

Understanding the causes and consequences of inflation is essential for policymakers and individuals alike. By understanding how inflation works, we can better prepare for its effects and make informed decisions about how to protect ourselves from its negative consequences.

Table: Causes and Consequences of Inflation

| Cause | Consequence |

|---|---|

| Increase in money supply | Reduced purchasing power |

| Increase in demand | Increased interest rates |

| Supply shocks | Uncertainty |

| Government policies | Reduced economic growth |