Getting your financial reporting and analysis done accurately and on time is crucial for any business. It provides valuable insights into your company's financial health, helps you make informed decisions, and ensures compliance with regulations.

Editor's Note: "Comprehensive Financial Reporting And Analysis: A Guide To Timely And Accurate 決算スケジュール" was published on [date] and explains everything you need to know about creating timely and accurate financial reports and analysis.

We've done the work of analyzing and gathering information, along with putting together this guide to help you make the right decisions for your business.

The following are some of the key takeaways from "Comprehensive Financial Reporting And Analysis: A Guide To Timely And Accurate 決算スケジュール":

| Key Differences | Key Takeaways |

| Importance of timely and accurate financial reporting | Accurate and timely financial reporting helps businesses make informed decisions, secure financing, and comply with regulations. |

| Benefits of using a 決算スケジュール | A 決算スケジュール can help businesses streamline their financial reporting process, improve accuracy, and save time. |

| Steps to create a 決算スケジュール | To create an effective 決算スケジュール, businesses should involve key stakeholders, set realistic deadlines, and assign clear responsibilities. |

| Common challenges in financial reporting | Some of the common challenges in financial reporting include gathering data, ensuring accuracy, and meeting deadlines. |

| Tips for improving financial reporting accuracy | Businesses can improve the accuracy of their financial reporting by using accounting software, automating processes, and conducting regular reviews. |

For more information, please read "Comprehensive Financial Reporting And Analysis: A Guide To Timely And Accurate 決算スケジュール" today.

FAQ

A well-defined financial reporting schedule is vital for timely and accurate financial reporting. This FAQ section addresses common concerns or misconceptions regarding comprehensive financial reporting and analysis.

Question 1: What are the key benefits of implementing a comprehensive financial reporting schedule?

Answer: It enhances financial transparency, facilitates timely decision-making, improves operational efficiency, and strengthens compliance with regulatory requirements.

Question 2: How can I ensure the accuracy and reliability of financial reports?

Answer: Establish clear accounting policies, implement robust internal controls, conduct regular audits, and maintain segregation of duties.

Question 3: What are the common challenges in financial reporting and how can I overcome them?

Answer: Challenges include data availability, data quality, and interpretation complexity. Overcoming these requires effective data management, leveraging technology, and seeking expert guidance.

Question 4: How does timely financial reporting benefit stakeholders?

Answer: It provides investors with up-to-date information for decision-making, enhances transparency for regulators and auditors, and enables informed analysis by creditors and analysts.

Question 5: What are the consequences of non-compliance with financial reporting regulations?

Answer: Non-compliance can lead to fines, penalties, reputational damage, and loss of investor confidence.

Question 6: How can I stay informed about the latest financial reporting updates and best practices?

Answer: Attend industry conferences, subscribe to professional publications, and seek guidance from reputable accounting firms or financial advisors.

Tips for Comprehensive Financial Reporting and Analysis

Financial reporting is a crucial aspect of any organization, and it is essential to ensure that the process is timely and accurate. Comprehensive Financial Reporting and Analysis: A Guide To Timely And Accurate 決算スケジュール provides valuable insights and best practices for enhancing the efficiency and effectiveness of financial reporting.

Tip 1: Establish a Clear 決算スケジュール

A well-defined 決算スケジュール outlines the deadlines and responsibilities for each step of the financial reporting process. This clarity helps prevent delays and ensures that all parties involved are aware of their roles and timelines.

Tip 2: Utilize Technology for Automation

Automating tasks such as data collection and report generation can significantly reduce the time and effort required for financial reporting. This frees up resources for more complex and value-added activities.

Tip 3: Foster Collaboration and Communication

Open and regular communication among the finance team, management, and auditors is essential to identify and resolve any issues promptly. Collaborative efforts ensure that financial reporting is accurate, reliable, and meets stakeholder expectations.

Tip 4: Implement Internal Controls

Establishing robust internal controls helps safeguard the integrity of financial reporting by preventing errors and fraud. Regular reviews and updates of internal controls are necessary to maintain their effectiveness.

Tip 5: Seek External Expertise

Engaging external auditors or consultants can provide an independent perspective and enhance the credibility of financial reporting. Their expertise can also help identify areas for improvement and ensure compliance with applicable regulations.

Tip 6: Continuously Monitor and Improve

The financial reporting process should be subject to ongoing monitoring and evaluation to identify areas for improvement. Regular reviews help ensure that reporting remains efficient, accurate, and relevant to stakeholder needs.

Tip 7: Enhance Disclosure and Transparency

Providing transparent and comprehensive financial disclosures enables stakeholders to make informed decisions. Disclosing key assumptions, uncertainties, and risks associated with the financial statements enhances the credibility and usefulness of financial reporting.

Tip 8: Prioritize Timeliness and Accuracy

Timely and accurate financial reporting is vital for effective decision-making and stakeholder confidence. Accurate reporting ensures the reliability of financial information, while timeliness allows stakeholders to make informed decisions based on the most up-to-date information.

By implementing these tips, organizations can enhance the efficiency and effectiveness of their financial reporting processes, ensuring timely and accurate reporting that meets the needs of stakeholders. Accurate financial reporting is the foundation for sound decision-making, risk management, and overall financial health.

Comprehensive Financial Reporting And Analysis: A Guide To Timely And Accurate 決算スケジュール

Comprehensive financial reporting and analysis is crucial for timely and accurate 決算スケジュール. This involves adhering to reporting standards, leveraging technology, fostering collaboration, ensuring data integrity, and continuous monitoring.

- Adherence to Standards: IFRS, GAAP, or local regulations guide reporting.

- Technology Leverage: Automation tools enhance efficiency and accuracy.

- Collaboration: Involving cross-functional teams ensures completeness.

- Data Integrity: Maintaining reliable and consistent financial data is paramount.

- Continuous Monitoring: Regular reviews identify and address reporting issues timely.

- Timely Reporting: Meeting deadlines ensures transparency and stakeholder confidence.

These aspects work in synergy to ensure timely and accurate 決算スケジュール. For instance, adhering to standards provides a framework for consistent reporting, while technology leverage automates processes and reduces errors. Collaboration fosters knowledge sharing and ensures completeness. Data integrity safeguards the reliability of reported information, and continuous monitoring proactively identifies and resolves discrepancies. Ultimately, timely reporting enhances transparency and facilitates informed decision-making.

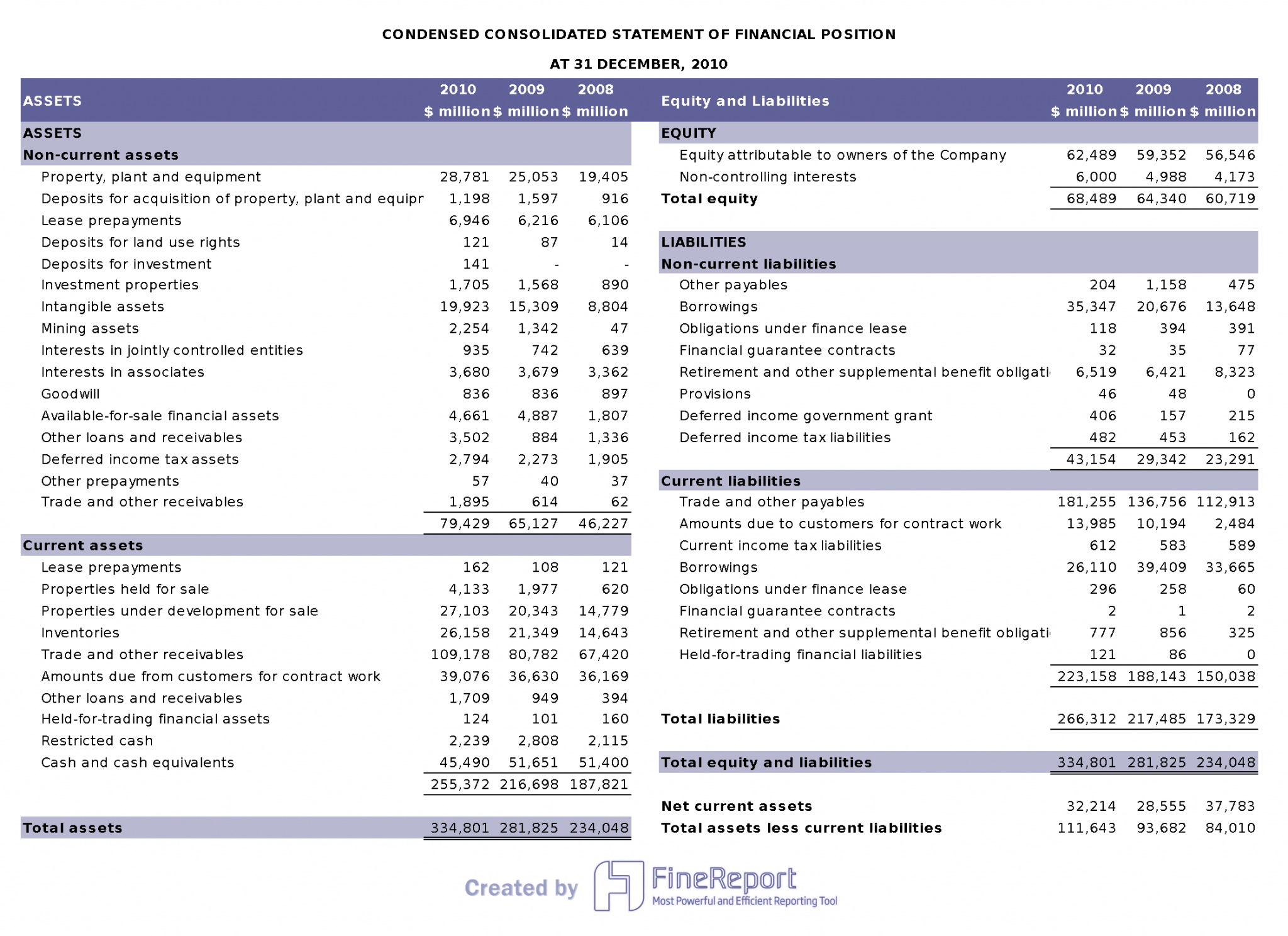

Financial Reporting & Financial Analysis: Definitive Guide | FineReport - Source www.finereport.com

Comprehensive Financial Reporting And Analysis: A Guide To Timely And Accurate 決算スケジュール

Comprehensive Financial Reporting And Analysis: A Guide To Timely And Accurate 決算スケジュール provides a comprehensive guide to the principles and practices of financial reporting and analysis. It covers a wide range of topics, including the preparation of financial statements, the analysis of financial data, and the use of financial information for decision-making. The book is written in a clear and concise style, and it is packed with practical examples and case studies. Comprehensive Financial Reporting And Analysis: A Guide To Timely And Accurate 決算スケジュール is an essential resource for anyone who wants to understand the world of financial reporting and analysis.

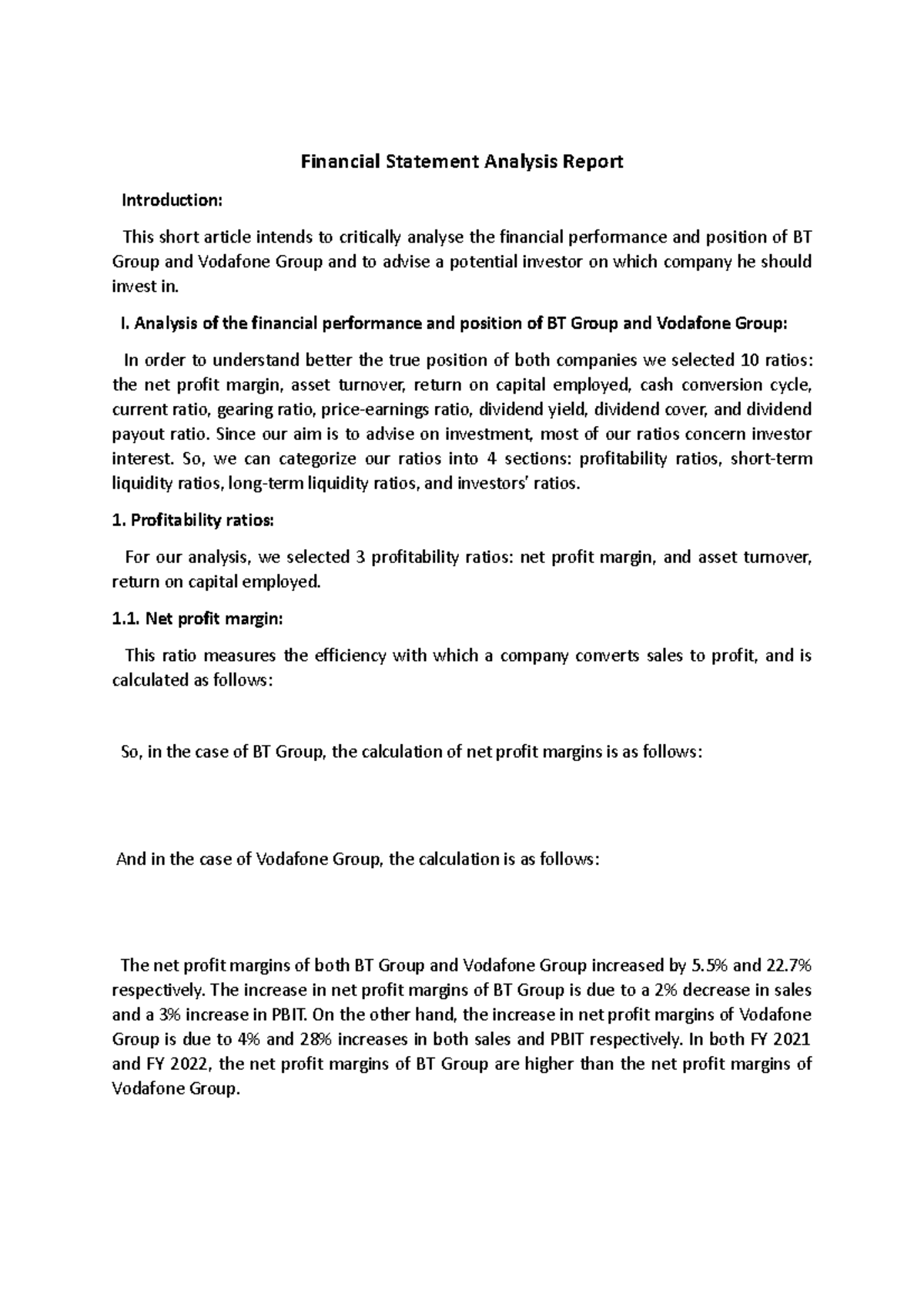

Financial Reporting Assignment 2 Final - Financial Statement Analysis - Source www.studocu.com

Timely and accurate financial reporting is essential for a number of reasons. First, it allows investors and creditors to make informed decisions about whether or not to invest in or lend money to a company. Second, it helps companies to track their financial performance and identify areas where they can improve. Third, it can help companies to avoid financial distress and bankruptcy. The 決算スケジュール is a key component of financial reporting. It outlines the steps that a company must take to prepare its financial statements and provides a timeline for completing these steps. By following the 決算スケジュール, companies can ensure that their financial statements are accurate and timely.

There are a number of ways to improve the timeliness and accuracy of financial reporting. One way is to use a financial reporting software program. These programs can help companies to automate many of the tasks involved in financial reporting, which can save time and reduce errors. Another way to improve timeliness and accuracy is to have a well-trained staff. Financial reporting is a complex process, and it is important to have staff who are knowledgeable about the requirements and who can prepare accurate financial statements.

Timely and accurate financial reporting is essential for businesses of all sizes. By following the 決算スケジュール and taking other steps to improve timeliness and accuracy, companies can improve their financial performance and avoid financial distress.

Table: Benefits of Timely and Accurate Financial Reporting

| Benefit | Description |

|---|---|

| Improved decision-making | Timely and accurate financial reporting provides investors and creditors with the information they need to make informed decisions about whether or not to invest in or lend money to a company. |

| Improved financial performance | Timely and accurate financial reporting helps companies to track their financial performance and identify areas where they can improve. |

| Reduced financial distress | Timely and accurate financial reporting can help companies to avoid financial distress and bankruptcy. |