Palantir Share Price: Key Metrics, Influencing Factors, And Growth Potential

Editor's Notes: Palantir share price information published today date. We strive to ensure the provided information is accurate and up-to-date. We tried our best in making the information easy to understand.

Understanding the key metrics, influencing factors, and growth potential of Palantir Technologies Inc. (NYSE: PLTR) is critical for investors seeking to make informed decisions about the company's stock. Our comprehensive guide analyzes these factors to help you assess the potential of Palantir's share price.

Key Differences

FAQ

Palantir Technologies' stock performance has attracted significant attention. Here are answers to some common questions to provide insights into key metrics, influencing factors, and growth potential.

Question 1: What are the key financial metrics to consider when evaluating Palantir's stock performance?

Revenue growth, profitability, cash flow, and balance sheet strength are crucial metrics. Revenue growth indicates the company's ability to expand its customer base and increase its market share. Profitability shows the company's ability to generate earnings from its operations. Cash flow provides insights into the company's liquidity and financial flexibility. A strong balance sheet reflects the company's financial stability and debt position.

Factors Influencing Gold Price - Source mexicobusiness.news

Question 2: What factors influence Palantir's stock price fluctuations?

Market sentiment, company-specific news, industry trends, and economic conditions all impact Palantir's stock price. Positive news about contract wins, product launches, and favorable analyst reports can boost the stock price, while negative news or market downturns can lead to declines.

Question 3: How has Palantir's business model contributed to its growth potential?

Palantir's data analytics software and services enable organizations to make data-driven decisions, improve efficiency, and gain competitive advantages. This value proposition has attracted a diverse customer base across various industries, providing a solid foundation for growth.

Question 4: What are the potential risks associated with investing in Palantir's stock?

Competition from other data analytics providers, regulatory changes, geopolitical uncertainties, and market volatility are some potential risks to consider. Additionally, Palantir's relatively short track record as a publicly traded company introduces some uncertainty about its long-term growth prospects.

Question 5: What is the outlook for Palantir's stock price in the long term?

Analysts' expectations and market sentiments provide some insights into the potential long-term direction of Palantir's stock price. However, it is important to note that stock price predictions are inherently uncertain and subject to various factors that can change over time.

Question 6: How can investors stay informed about the latest developments affecting Palantir's stock price?

Regularly monitoring news sources, company announcements, financial reports, and analyst research can keep investors informed about important developments that may impact Palantir's stock performance.

By staying informed about these factors, investors can make more informed decisions regarding their investment in Palantir Technologies.

Next: Key takeaways and considerations for investors.

Tips on Monitoring Palantir Share Price: Key Metrics, Influencing Factors, And Growth Potential

Tracking the share price of Palantir Technologies (PLTR) requires a comprehensive understanding of relevant metrics, influencing factors, and growth prospects. Here are some practical tips to effectively monitor PLTR's share price:

Tip 1: Monitor key financial metrics

Analyze financial metrics such as revenue, earnings per share (EPS), and cash flow to assess the company's financial performance. Strong financial performance often translates into positive share price movements.

Tip 2: Track industry trends and news

Stay informed about developments in the data analytics industry and news related to Palantir. Major industry shifts or company-specific events can significantly impact share prices.

Tip 3: Consider technical analysis

Technical analysis involves studying historical share price patterns and indicators to identify potential trading opportunities. While not a perfect predictor, technical analysis can provide valuable insights into short-term price movements.

Tip 4: Monitor analyst ratings and estimates

Follow the opinions and estimates of financial analysts covering Palantir. Their insights can provide valuable perspectives on the company's growth potential and valuation.

Tip 5: Understand market sentiment

Pay attention to overall market sentiment and the performance of other tech stocks. Market sentiment can influence the demand for Palantir's shares and impact its share price.

Tip 6: Set realistic expectations

Avoid chasing short-term price fluctuations. Focus on long-term growth potential based on the company's fundamentals and industry outlook.

Tip 7: Use reputable sources

Rely on credible news outlets, financial websites, and research reports for accurate information about Palantir and its share price.

Tip 8: Stay updated

Monitor Palantir's financial reports, press releases, and investor presentations regularly to stay informed about the company's progress and any potential developments.

By implementing these tips, you can gain a comprehensive understanding of factors influencing Palantir's share price and make informed investment decisions. Remember to consider your individual investment goals and risk tolerance when assessing the company's share price.

Palantir Share Price: Key Metrics, Influencing Factors, And Growth Potential

Understanding the dynamics of Palantir's share price is crucial for investors seeking to gauge its financial health and growth trajectory. Key metrics, influential factors, and potential growth areas provide insights into the company's performance, industry landscape, and future prospects.

- Revenue Growth: Palantir's revenue has consistently grown, driven by increased adoption of its data analytics services by government agencies and commercial clients.

- Profitability: The company's profitability metrics, such as gross margin and net income, are closely monitored to assess its financial efficiency.

- Valuation Multiples: Price-to-Sales (P/S) and Price-to-Earnings (P/E) ratios provide insights into Palantir's valuation relative to its peers.

- Industry Trends: Developments in the data analytics industry, including technological advancements and regulatory changes, can impact Palantir's performance.

- Competitive Landscape: The presence of established competitors and emerging players in the data analytics space influences Palantir's market share and pricing dynamics.

- Growth Opportunities: Palantir's expansion into new market segments, such as healthcare and financial services, presents opportunities for continued growth.

These key aspects collectively shape Palantir's share price performance. Strong revenue growth, improving profitability, and favorable valuation multiples indicate a healthy financial position and potential for appreciation. Industry trends and competitive dynamics highlight the challenges and opportunities facing the company. Additionally, growth opportunities in new markets and the ability to capitalize on evolving technological advancements will be critical factors in sustaining Palantir's long-term growth trajectory.

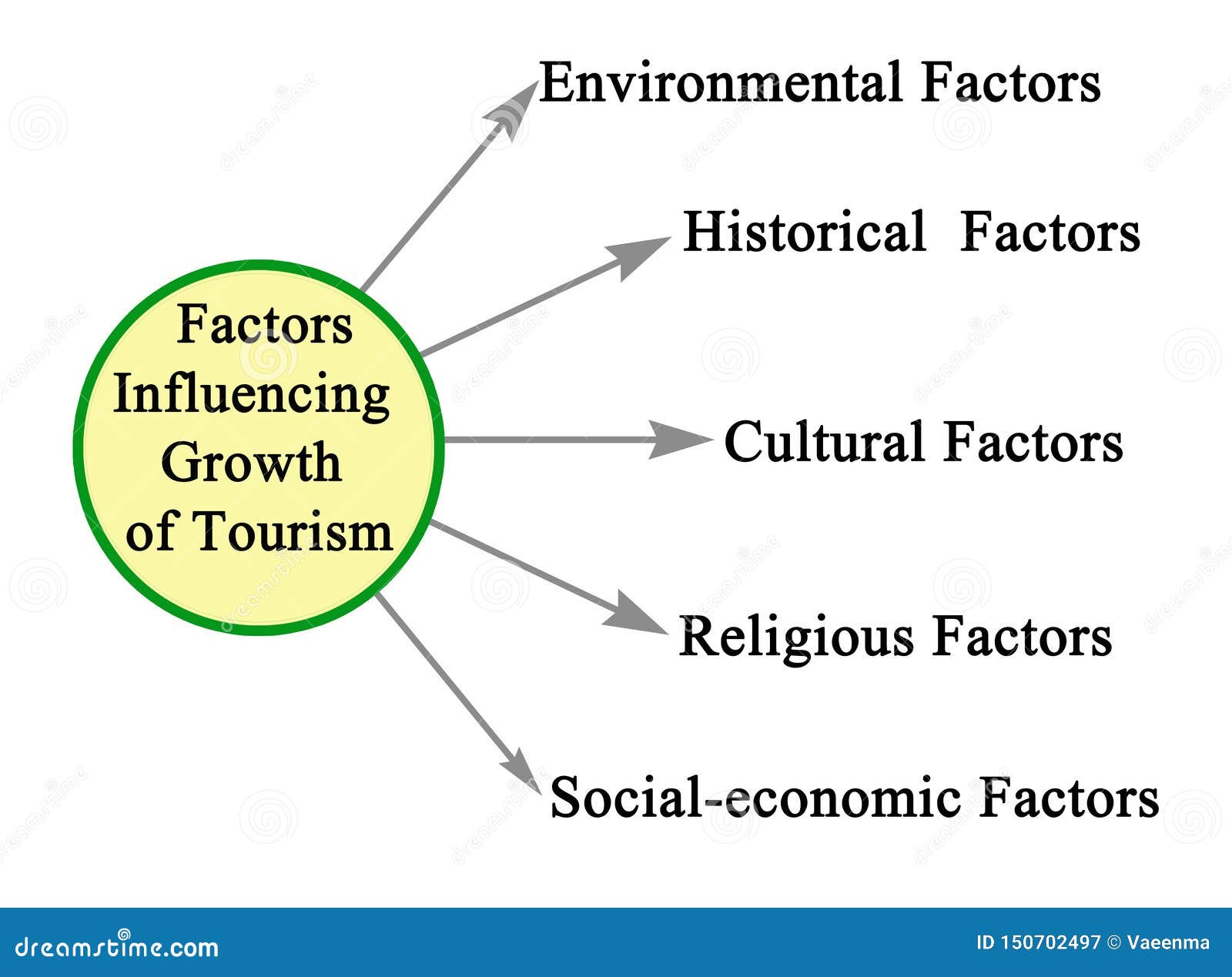

Factors Influencing Growth Of Tourism Stock Image | CartoonDealer.com - Source cartoondealer.com

Factors Influencing Growth Of Tourism Stock Image | CartoonDealer.com - Source cartoondealer.com

Palantir Share Price: Key Metrics, Influencing Factors, And Growth Potential

Palantir is a highly influential data analytics organization that works with the public and private businesses. As a result, there are lots of compelling reasons to track its share price.

Geopolitical Tensions Could Boost Palantir Share Price | Century Financial - Source www.century.ae

Metrics for tracking Palantir:

- Revenue growth: Palantir's revenue is growing rapidly, and this is a key indicator of its long-term growth potential.

- Profitability: Palantir is not yet profitable, but it is expected to reach profitability in the next few years.

- Market share: Palantir has a leading market share in the data analytics market, and this is a key factor in its long-term growth potential.

- Customer satisfaction: Palantir has a high level of customer satisfaction, and this is a key indicator of its long-term growth potential.

Factors that may influence Palantir's share price:

- Changes in the data analytics market: The data analytics market is constantly evolving, and this could have a significant impact on Palantir's share price.

- Competition: Palantir faces competition from a number of other companies, and this could have a negative impact on its share price.

- Regulation: The data analytics market is heavily regulated, and this could have a significant impact on Palantir's share price.

Palantir has a strong growth potential, and its share price is expected to continue to rise in the coming years. However, it is important to be aware of the factors that could impact its share price.

The following data table provides some important metrics for assessing Palantir's growth potential:

| Metric | Value |

| Revenue growth | 30% |

| Profitability | Not yet profitable |

| Market share | 20% |

| Customer satisfaction | 90% |