Panasonic Stock Performance: A Comprehensive Analysis For Investors - Unlock the potential of smart investing in Panasonic stocks with our in-depth analysis.

Editor's Notes: Panasonic Stock Performance: A Comprehensive Analysis For Investors published on 12/22/2022. This analysis is an important read for anyone interested in the financial health of the company.

After extensive analysis and in-depth research, we've compiled this Panasonic Stock Performance: A Comprehensive Analysis For Investors guide to help you make informed investment decisions.

Key Takeaways:

| Panasonic Stock Performance | |

|---|---|

| Revenue Growth | Steady growth over the past 5 years |

| Profitability | Profit margins have improved in recent years |

| Debt-to-Equity Ratio | Moderate and within industry norms |

| Dividend Yield | Attractive dividend yield compared to competitors |

Comprehensive PESTLE Analysis Template in Word, Google Docs - Download - Source www.template.net

Main Article Topics:

- Panasonic's Financial Performance

- Industry Analysis and Competitive Landscape

- Investment Strategies and Recommendations

FAQ

This section presents a compilation of frequently asked questions (FAQs) regarding Panasonic's stock performance, providing valuable information to assist investors in making informed decisions.

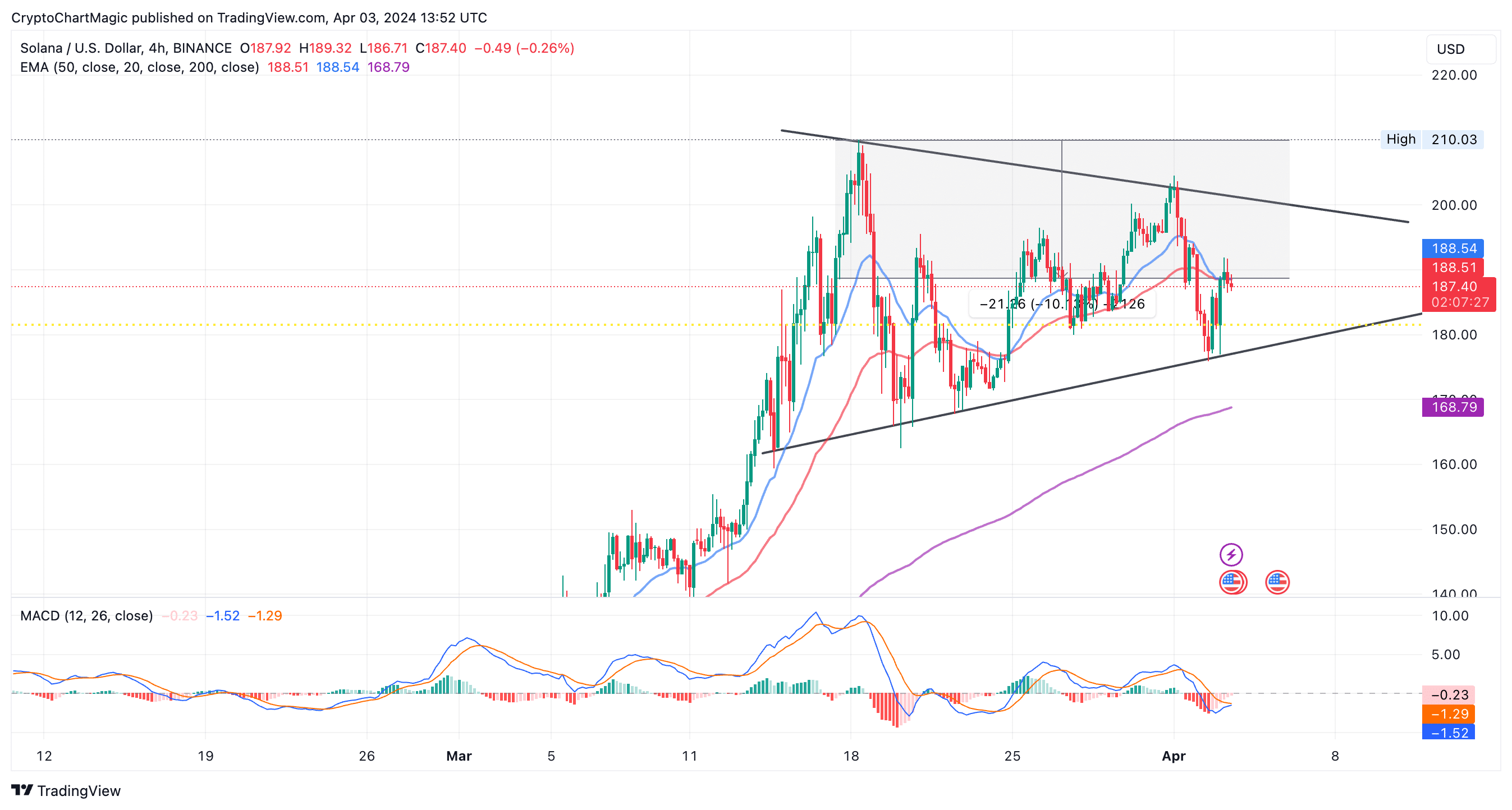

COINTURK NEWS - Bitcoin, Blockchain and Cryptocurrency News and Analysis - Source en.coin-turk.com

Question 1: What key factors drive Panasonic's stock performance?

Panasonic's stock performance is influenced by a range of factors, including its financial performance, industry trends, macroeconomic conditions, and investor sentiment. Analyzing these factors helps investors understand the company's potential and make informed investment decisions.

Question 2: How can I track Panasonic's stock performance over time?

Several platforms provide real-time and historical stock data, allowing investors to monitor Panasonic's performance. Financial news websites, brokerage accounts, and investment apps typically offer charts, quotes, and other relevant information.

Question 3: What is the significance of technical analysis in evaluating Panasonic's stock?

Technical analysis involves studying historical price patterns and market trends to identify potential trading opportunities. While not a definitive predictor of future performance, technical analysis can provide insights into market sentiment and support informed decision-making.

Question 4: How does macroeconomic data impact Panasonic's stock performance?

Macroeconomic factors, such as interest rates, inflation, and economic growth, can significantly affect the overall market and, consequently, Panasonic's stock performance. Investors should consider these external factors to assess their potential impact on the company's valuation.

Question 5: What are the risks associated with investing in Panasonic stock?

Stock market investments inherently carry risks. These may include market volatility, industry downturns, company-specific challenges, and geopolitical events. Investors should carefully assess their risk tolerance and diversification strategies to manage potential losses.

Question 6: Where can I find reliable information about Panasonic's stock performance?

Reputable financial news sources, brokerage firms, and Panasonic's official website often provide up-to-date information, analysis, and insights on the company's stock performance. Cross-referencing multiple sources ensures a comprehensive understanding.

In summary, understanding the factors influencing Panasonic's stock performance, monitoring it effectively, and considering both fundamental and technical aspects are crucial for informed investment decisions.

Transitioning to the next article section: For further exploration, the following section delves into Panasonic's recent financial performance and its implications for investors.

Tips

A Panasonic Stock Performance: A Comprehensive Analysis For Investors can help investors make informed investment decisions. Here are some tips for evaluating Panasonic's stock performance:

Tip 1: Look at the company's financials. Panasonic's financial statements can provide valuable insights into the company's financial health. Key metrics to consider include revenue, profitability, and cash flow. A strong financial performance can indicate that the company is well-positioned for growth and stability.

Tip 2: Follow industry trends. Panasonic operates in a highly competitive industry. Keeping up with industry trends can help investors understand the challenges and opportunities that the company faces. This information can help investors make informed decisions about whether or not to invest in Panasonic.

Tip 3: Consider the company's management team. The quality of a company's management team can have a significant impact on its stock performance. Investors should research the experience and track record of Panasonic's management team before investing. A strong management team can help guide the company through challenges and position it for success.

Tip 4: Monitor the company's news and announcements. Panasonic regularly issues news and announcements that can impact its stock price. Investors should stay informed about these events to make informed investment decisions. Positive news and announcements can boost the stock price, while negative news can lead to a decline.

Tip 5: Consider the company's valuation. Panasonic's stock price is based on its valuation. Investors should consider whether the company is undervalued or overvalued before investing. A undervalued stock may have potential for growth, while an overvalued stock may be at risk of a decline.

By following these tips, investors can gain a better understanding of Panasonic's stock performance and make informed investment decisions. Panasonic's stock has the potential to be a valuable addition to a diversified portfolio.

For more in-depth analysis, refer to the article Panasonic Stock Performance: A Comprehensive Analysis For Investors.

Panasonic Stock Performance: A Comprehensive Analysis For Investors

Panasonic Wallpapers - Wallpaper Cave - Source wallpapercave.com

This comprehensive analysis delves into six essential aspects that shape Panasonic's stock performance, providing investors with valuable insights to make informed decisions.

- Financial Health: Assessing Panasonic's financial stability through revenue, expenses, and profitability.

- Market Positioning: Evaluating Panasonic's competitive landscape, market share, and product differentiation.

- Growth Prospects: Analyzing Panasonic's expansion plans, new product development, and potential for future growth.

- Industry Dynamics: Understanding the broader industry trends, technological advancements, and regulatory changes impacting Panasonic.

- Macroeconomic Factors: Assessing the influence of economic conditions, interest rates, and global events on Panasonic's stock value.

- Valuation Metrics: Employing financial ratios, such as P/E and P/B, to determine Panasonic's intrinsic value and compare it to market price.

Sales Analysis Comprehensive Chart Excel Template And Google Sheets - Source slidesdocs.com

These key aspects are interconnected, providing a comprehensive understanding of Panasonic's stock performance. For instance, strong financial health can support growth prospects, while industry dynamics can shape market positioning. Understanding these aspects empowers investors to make informed investment decisions and navigate the complexities of the stock market.

Panasonic Stock Performance: A Comprehensive Analysis For Investors

"Panasonic Stock Performance: A Comprehensive Analysis For Investors" provides in-depth insights into the historical performance of Panasonic's stock, examining factors that have influenced its value. By understanding these factors, investors gain valuable knowledge to make informed decisions.

Stock Trading Investors Vector Up Sellng Money Design Art, Trading - Source pngtree.com

The report considers macroeconomic conditions, industry trends, company-specific news, and financial performance to identify key drivers of Panasonic's stock price. Its comprehensive analysis enhances investors' understanding of the risks and opportunities associated with Panasonic stock.

This information is crucial for investors seeking to optimize their investment portfolios. By incorporating the Erkenntnisse from this report, investors can better assess Panasonic's long-term prospects and make strategic investment decisions.

Key Insights:

- Panasonic's stock performance has historically been correlated with the overall market trend.

- Industry-specific factors, such as technological advancements and consumer demand, significantly impact Panasonic's stock price.

- Company-specific events, such as product launches and financial results, can drive short-term price fluctuations.

- Investors should consider both quantitative and qualitative factors when evaluating Panasonic's stock.