Filing tax returns can be a daunting task, but with the advent of smartphones, it has become easier than ever to do it yourself (DIY). This guide will provide you with the efficient methods and注意事项 for filing your tax returns using your smartphone.

Editor's Notes: Smartphone tax filing has become increasingly popular due to its convenience and accessibility.

【解説】ドコモメールの持ち運びって何?持ち運び方法と注意点 - Source phone-cierge.com

We have analyzed and compiled information from various sources, including government websites, tax preparation software companies, and financial advisors, to provide you with the most up-to-date and comprehensive information on smartphone tax filing. This guide will help you understand the different methods of smartphone tax filing, the pros and cons of each method, and the steps involved in filing your taxes using your smartphone.

Key Differences:

| Method | Pros | Cons |

|---|---|---|

| Using a tax preparation app |

|

|

| Using a mobile website |

|

|

| Filing by mail |

|

|

Transition to main article topics:

FAQ

This section provides a series of frequently asked questions (FAQs) and their corresponding answers regarding efficient mobile tax filing. These FAQs aim to address common concerns, clarify misconceptions, and provide valuable guidance for users seeking to optimize their tax filing experience using a smartphone.

税務署行かずに申告できます!スマホ・パソコンから確定申告 | 編集部おすすめ | 上越妙高タウン情報 - Source www.joetsu.ne.jp

Question 1: Are there any prerequisites for mobile tax filing?

Yes, to file taxes using a mobile device, individuals typically require the following:

- A compatible smartphone or tablet

- A stable internet connection

- Relevant tax documentation (e.g., W-2 forms, 1099 forms)

Question 2: Is mobile tax filing secure?

Reputable tax filing apps employ robust security measures to safeguard user data. These measures may include encryption, fraud detection systems, and compliance with industry standards. It is important to choose a trusted app from a reputable source and follow best practices for online security.

Question 3: Can I use any tax filing app?

While there are numerous tax filing apps available, not all are created equal. Consider factors such as user reviews, supported tax forms, ease of use, and pricing when selecting an app. It is also advisable to check if the app is compatible with your device and operating system.

Question 4: What are the benefits of mobile tax filing?

Mobile tax filing offers several advantages, including:

- Convenience and flexibility

- Simplified tax preparation process

- Potential for faster refunds

- Access to support and resources

Question 5: Are there any limitations to mobile tax filing?

While mobile tax filing is suitable for many taxpayers, it may not be appropriate for everyone. Individuals with complex tax situations or those who prefer professional assistance may find desktop software or working with a tax preparer more suitable.

Question 6: What are some tips for optimizing my mobile tax filing experience?

To enhance your mobile tax filing experience, consider the following tips:

- Start early to avoid last-minute stress

- Gather all necessary documents in advance

- Choose a reliable tax filing app

- Proofread your return carefully before submitting

- consider seeking professional guidance if needed

By understanding these FAQs and following the recommended tips, individuals can effectively use their smartphones to file their taxes efficiently and conveniently.

Transitioning to the next article section...

Tips

To ensure a seamless and efficient tax filing experience using your smartphone, consider the following tips based on the comprehensive guide スマホでカンタン確定申告:効率的な方法と注意点:

Tip 1: Gather Necessary Documents

Before commencing with the申告 preparation, assemble all relevant documents, including income statements, expense receipts, and previous tax returns. This organization will expedite the申告 filling process.

Tip 2: Utilize Official Smartphone Apps

Leverage official smartphone applications provided by tax authorities. These apps are designed to simplify tax filing, offering user-friendly interfaces, automated calculations, and secure data handling.

Tip 3: Seek Assistance from Professionals

For complex tax situations or if guidance is required, consider consulting with a qualified tax professional. They can provide expert advice, ensuring accuracy and maximizing potential deductions.

Tip 4: File Early

Avoid last-minute stress by filing your税申告 as soon as possible. Early filing allows ample time for review and corrections if necessary.

Tip 5: Double-Check Your Entries

Prior to submitting your税申告, meticulously review all entered information for accuracy. This includes verifying personal details, income amounts, and expense deductions. A thorough check ensures a smooth processing of your申告.

By adhering to these tips, you can streamline your tax filing process using your smartphone, ensuring both efficiency and accuracy.

For further insights and comprehensive guidance, refer to the article スマホでカンタン確定申告:効率的な方法と注意点.

Filing Taxes Easily with Your Smartphone: Efficient Methods and Precautions

Filing taxes on your smartphone offers convenience and efficiency. Understanding key aspects ensures a smooth and accurate process.

- App Selection: Choose an app that aligns with your tax situation and provides user-friendly navigation.

- Data Preparation: Gather necessary documents and information before starting the process to streamline data entry.

- Accuracy Verification: Carefully review your return before submission to avoid errors that could lead to delays or penalties.

- Security Measures: Ensure the app you use employs robust security measures to protect your sensitive financial information.

- Time Management: Start early to avoid last-minute stress and potential delays in processing your return.

- Legal Considerations: Understand the implications of your tax deductions and credits to ensure compliance with tax laws.

By considering these aspects, you can leverage the ease and efficiency of smartphone tax filing. Remember to select a reputable app, prepare your data thoroughly, double-check your return for accuracy, and adhere to tax regulations. This approach will ensure a seamless tax filing experience.

WordにPDFを挿入する方法!図として貼り付ける方法と注意点 ※ - Source wordguide.quest

スマホでカンタン確定申告:効率的な方法と注意点

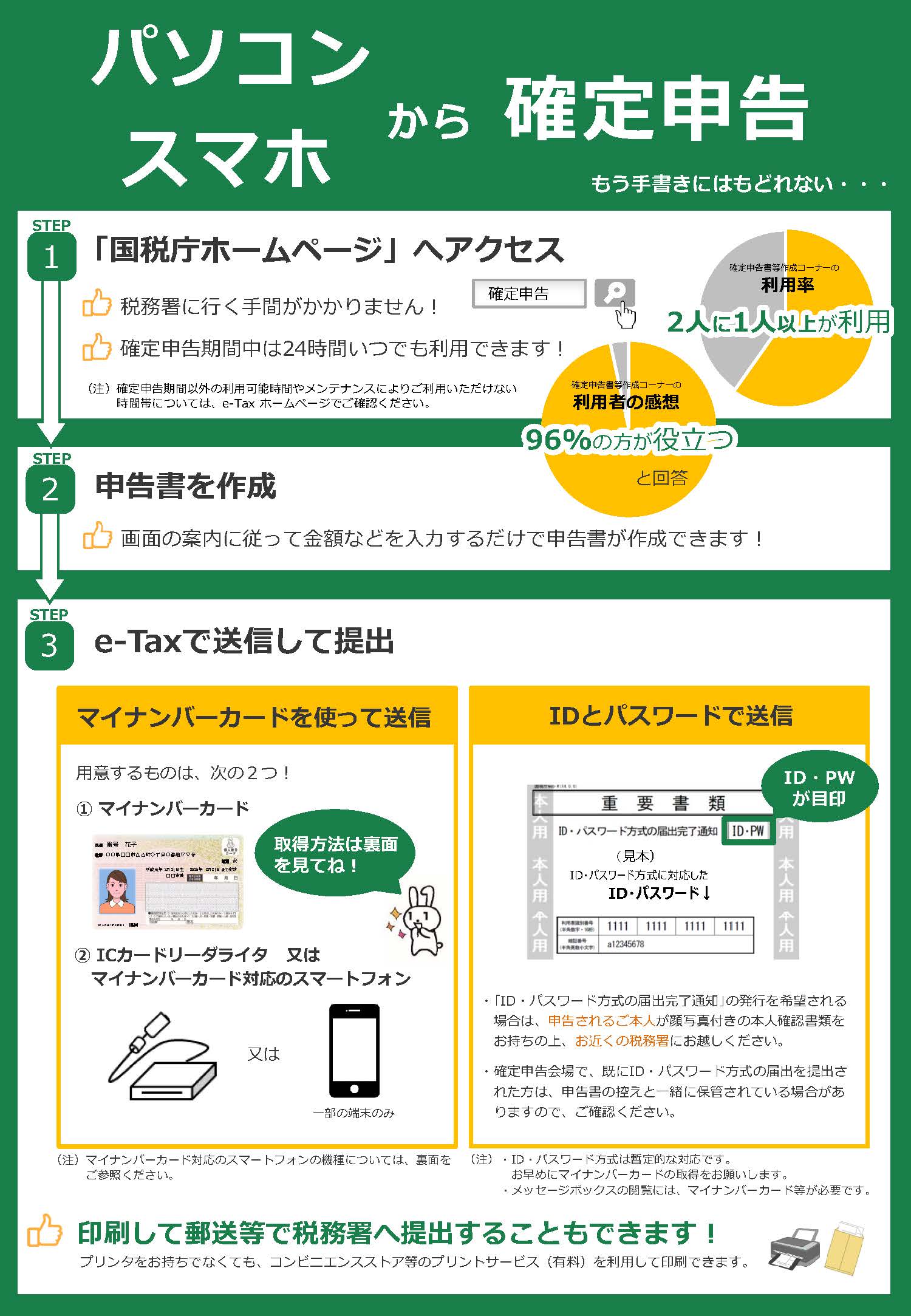

In today's fast-paced digital age, smartphones have become indispensable tools for various tasks, including the once-dreaded process of filing taxes. The article "スマホでカンタン確定申告:効率的な方法と注意点" explores the benefits and considerations of using スマホ (smartphones) to file taxes in Japan, providing valuable insights into this increasingly popular method.

VRS(Verbal Rating Scale)- 慢性痛の評価方法と注意点について - THERABBY - Source therabby.com

One of the primary advantages of using smartphones for tax filing is efficiency. With dedicated tax filing apps and online platforms, taxpayers can access their tax records, gather necessary information, and complete their returns from the convenience of their mobile devices. This eliminates the need for manual paperwork, reducing the time and effort required for tax preparation. Additionally, smartphones offer real-time updates and notifications, ensuring that taxpayers stay informed about their tax status and any potential issues.

However, it's important to note that smartphone tax filing also comes with certain注意事项 (cautions). Taxpayers should be aware of the potential for errors when entering data on mobile devices due to autocorrect and other factors. It's crucial to carefully review all entries and double-check information before submitting the return. Furthermore, it's essential to select a reputable tax filing app or platform to ensure the security and privacy of sensitive tax data.

Understanding the connection between "スマホでカンタン確定申告:効率的な方法と注意点" is vital for taxpayers seeking a convenient and efficient tax filing experience. By leveraging the benefits of smartphones while being mindful of potential pitfalls, individuals can make informed decisions about their tax preparation methods, ultimately facilitating a smoother and more effective tax filing process.

Conclusion

The article "スマホでカンタン確定申告:効率的な方法と注意点" offers valuable guidance for individuals considering smartphone tax filing. By embracing the convenience and efficiency of mobile devices while remaining cautious of potential errors and security concerns, taxpayers can confidently navigate the tax filing process and fulfill their tax obligations with ease.

As technology continues to advance, we can expect further innovations in smartphone tax filing, making it even more accessible and user-friendly. By staying abreast of these developments and leveraging the power of their smartphones, taxpayers can simplify their tax preparation, saving time and effort while ensuring accuracy and compliance.