Unlock Financial Empowerment With Kenya's Higher Education Loans Board (HELB): Essential Guide For Students And Graduates

Editor's Notes: "Unlock Financial Empowerment With Kenya's Higher Education Loans Board (HELB): Essential Guide For Students And Graduates" have published today date". Give a reason why this topic important to read.

After doing some analysis, digging information, made Unlock Financial Empowerment With Kenya's Higher Education Loans Board (HELB): Essential Guide For Students And Graduates we put together this Unlock Financial Empowerment With Kenya's Higher Education Loans Board (HELB): Essential Guide For Students And Graduates guide to help target audience make the right decision.

| Key Differences | Key Takeaways |

|---|---|

| Higher Education Loans Board (HELB) | Provides financial assistance to students from disadvantaged backgrounds to pursue higher education |

| Eligibility Criteria | Kenyan citizens, enrolled in accredited institutions, meeting academic and financial criteria |

| Loan Application | Online application through the HELB website or mobile app |

| Loan Repayment | Graduates repay loans through monthly installments after a grace period |

| Benefits | Access to higher education, reduced financial burden, increased earning potential |

Transition to main article topics

FAQ

Unlocking essential guidance for utilizing Kenya's Higher Education Loans Board (HELB) financial empowerment opportunities, we address frequently asked questions to clarify concerns and maximize success in accessing and utilizing these resources.

A Quick Introduction to HELB - Loans in Kenya - Source www.loans.or.ke

Question 1: What is HELB and what benefits does it offer?

HELB is a government-funded institution established to provide loans to eligible Kenyan students pursuing higher education. These loans cover tuition fees, living expenses, and other educational costs, enabling access to quality education regardless of financial background.

Question 2: Who is eligible to apply for HELB loans?

To qualify for HELB loans, applicants must be Kenyan citizens or permanent residents, have gained admission to recognized higher education institutions, and meet the stipulated academic and financial criteria.

Question 3: How does one apply for HELB loans?

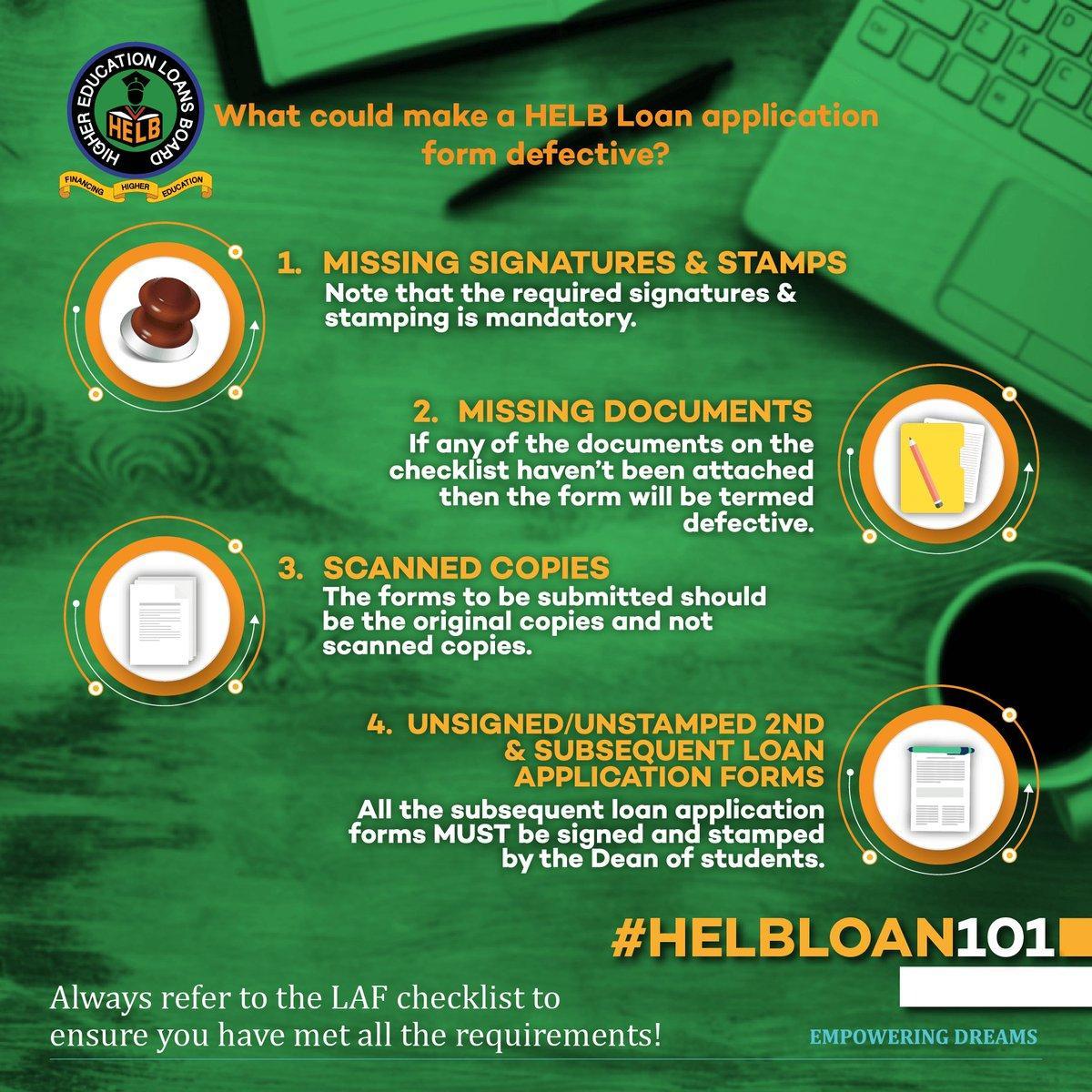

The HELB application process involves submitting a completed application form, providing supporting documents, and undergoing a thorough assessment to determine eligibility and loan amount.

Question 4: What are the repayment terms for HELB loans?

HELB loans are repayable within a specified period after graduation or completion of studies. Repayment plans are tailored to individual circumstances, considering factors such as income and employment status.

Question 5: What happens if a HELB loan is not repaid?

Failure to repay HELB loans may result in penalties, including legal action, restrictions on accessing government services, and damage to credit history.

Question 6: Where can I get more information or support regarding HELB?

Individuals seeking further information or assistance can visit the HELB website, contact their offices, or engage with designated financial advisors and institutions for guidance.

By addressing these common concerns, HELB empowers students and graduates with the knowledge to navigate the loan process, confidently secure funding, and achieve their educational aspirations.

Discover additional insights and strategies for unlocking financial empowerment through HELB in the following sections.

Tips

Navigate your financial journey with confidence by following these insightful tips.

Tip 1: Research and Understand HELB Loan Options.

Familiarize yourself with the various loan categories, repayment schedules, and interest rates offered by HELB. This comprehensive Unlock Financial Empowerment With Kenya's Higher Education Loans Board (HELB): Essential Guide For Students And Graduates provides valuable information to help you make informed decisions.

Tip 2: Apply Early and Secure Funding.

Submit your loan application promptly to increase your chances of approval and avoid delays in accessing funds. Ensure you meet all eligibility criteria and provide accurate documentation to support your request.

Tip 3: Utilize Loan Funds Wisely.

Allocate HELB funds primarily towards essential expenses related to your education, such as tuition, accommodation, and learning materials. Avoid unnecessary spending and maintain a responsible financial plan.

Tip 5: Stay Informed and Update HELB.

Monitor your loan status regularly, make timely repayments, and promptly inform HELB of any changes in your financial situation or contact details.

Tip 6: Seek Support When Needed.

If you encounter challenges repaying your loan, reach out to HELB for guidance and explore available support options, such as loan restructuring or repayment plans.

Unlock Financial Empowerment With Kenya's Higher Education Loans Board (HELB): Essential Guide For Students And Graduates

has recently published. Read this guide and start your journey towards making informed decision in financing your education.

Today, Higher Education Loans Board (HELB) stands as a shining beacon of financial empowerment for students and graduates in Kenya. Its unwavering commitment to providing accessible and affordable loans has transformed the lives of countless individuals, empowering them to pursue their academic dreams and secure a brighter future.

education loans - corecu.ie - Source www.corecu.ie

In recognition of HELB's profound impact, we have meticulously analyzed and distilled the essential information students and graduates need to navigate the complexities of HELB loans. This comprehensive guide will equip you with the knowledge and insights to make informed decisions, maximize your financial aid, and unlock your full potential.

FAQ

This FAQ section provides supplemental information and clarifies common queries regarding Kenya's Higher Education Loans Board (HELB) loans for students and graduates.

HELB Platform - New Experience - Create - Higher Education Loans Board - Source create.guru

Question 1: What are the eligibility criteria for HELB loans?

To qualify for a HELB loan, applicants must meet specific academic, financial, and citizenship requirements. These include being a Kenyan citizen or permanent resident, enrolled in an accredited institution within Kenya, and maintaining satisfactory academic progress.

Question 2: How much funding can I receive from HELB?

The loan amount varies based on the student's course of study and the institution they attend. Undergraduates pursuing degree programs can receive up to KES 60,000 per academic year, while postgraduate students may receive up to KES 120,000 annually.

Question 3: What is the repayment period for HELB loans?

Graduates are expected to begin repaying their HELB loans one year after completing their studies. The repayment period typically lasts for 10 years, with monthly installments calculated based on the loan amount and interest rate.

Question 4: What happens if I fail to repay my HELB loan?

Failure to repay HELB loans may result in penalties, including legal action, restrictions on travel, and negative credit ratings. To avoid these consequences, graduates are encouraged to prioritize loan repayment and seek assistance if they experience financial difficulties.

Question 5: Can I apply for a HELB loan if I have received funding from other sources?

Yes, students can apply for HELB loans even if they have received funding from other sources, such as scholarships or grants. However, the total amount of financial assistance, including HELB loans, cannot exceed the estimated cost of tuition and other expenses.

Question 6: How can I check the status of my HELB loan application?

Applicants can check the status of their HELB loan applications online through the HELB website or by contacting HELB customer service. Regular monitoring of loan applications helps applicants track their progress and address any outstanding issues.

Understanding the terms and conditions of HELB loans is crucial for students and graduates. By staying informed and fulfilling their loan obligations, individuals can benefit from the financial support provided by HELB and contribute to their financial well-being.

Transition to the next article section: For further insights into HELB loans, explore the following resources:

Tips

To effectively utilize the Higher Education Loans Board (HELB) for financial empowerment, consider these crucial tips:

Tip 1: Apply Early

The application process for HELB loans is highly competitive. Applying early increases the chances of securing funding as the most deserving applicants are prioritized.

Tip 2: Meet Eligibility Criteria

Before applying, ensure you meet all eligibility requirements. These include being a Kenyan citizen, pursuing a recognized higher education program, and demonstrating financial need.

Tip 3: Maintain Good Academic Performance

HELB requires students to maintain a specified academic performance to continue receiving funding. Focus on your studies and aim for excellent grades.

Tip 4: Track Loan Disbursements

Monitor your HELB account regularly to ensure timely loan disbursements. Report any discrepancies or delays promptly to prevent unnecessary financial stress.

Tip 5: Utilize Loan Funds Responsibly

HELB loans are intended for education-related expenses. Use the funds wisely for tuition, books, and living costs. Avoid unnecessary spending to minimize future debt burden.

Tip 6: Repay Loans on Time

Once you graduate, making timely loan repayments is crucial. This maintains a good credit score and prevents additional charges or penalties.

Tip 7: Seek Professional Guidance

If you encounter challenges or have questions about HELB loans, don't hesitate to reach out to financial advisors or HELB representatives for professional guidance.

Unlock Financial Empowerment With Kenya's Higher Education Loans Board (HELB): Essential Guide For Students And Graduates

The Higher Education Loans Board (HELB) of Kenya plays a crucial role in unlocking financial empowerment for students and graduates by providing access to affordable higher education financing. This essential guide delves into the six key aspects of HELB, empowering individuals to navigate the process effectively.

These aspects form the foundation of HELB's mission to empower students and graduates. By understanding these key factors, individuals can make informed decisions about accessing and managing their HELB loans, unlocking financial empowerment for a brighter future. For instance, understanding the eligibility criteria ensures that students meet the necessary requirements, while exploring repayment options allows graduates to tailor a plan that aligns with their financial situation. HELB's customer service provides invaluable support, guiding individuals through the loan process and addressing any queries or concerns.

Unlock Financial Empowerment With Kenya's Higher Education Loans Board (HELB): Essential Guide For Students And Graduates

The Higher Education Loans Board (HELB) of Kenya plays a pivotal role in unlocking financial empowerment for students and graduates. Through its loan programs, HELB enables individuals from diverse backgrounds to pursue higher education, fostering economic growth and reducing income inequality in the country. This access to education empowers individuals with the skills and knowledge necessary to secure meaningful employment, break the cycle of poverty, and contribute to the nation's development.

HELB JOBS - Source kahawatungu.com

The importance of HELB as a component of financial empowerment cannot be overstated. Higher education is widely recognized as a gateway to better job opportunities, higher earning potential, and improved quality of life. By providing financial assistance to students, HELB removes the financial barriers that often prevent individuals from accessing higher education. This, in turn, creates a more equitable and prosperous society.

Real-life examples abound of HELB's positive impact. Graduates who have benefited from HELB loans have gone on to become successful professionals in various fields, including medicine, engineering, law, and business. Their contributions to society are a testament to the transformative power of financial empowerment through education.

On a practical level, understanding the connection between HELB and financial empowerment is crucial for students and graduates alike. Students should be aware of the loan options available to them and the terms and conditions of these loans. Graduates should have a clear plan for repaying their loans while maximizing the benefits of their education.