Unlocking the Secrets of the Canadian Dollar: A Comprehensive Guide for Investors

Investing Wallpapers - Top Free Investing Backgrounds - WallpaperAccess - Source wallpaperaccess.com

Editor's Note: "The Ultimate Guide to Understanding and Investing in the Canadian Dollar" has been published today to provide valuable insights into this crucial topic. Understanding the Canadian dollar's complexities is essential for anyone seeking to invest in or engage with the Canadian economy.

Through meticulous analysis and extensive research, we have meticulously crafted this guide to empower our readers with the knowledge and strategies necessary to make informed decisions when investing in the Canadian dollar.

| Key Difference | Key Takeaway |

|---|---|

| Economic Stability | Canada's strong economic fundamentals make the Canadian dollar a relatively stable currency. |

| Commodity Dependence | The Canadian dollar's value is heavily influenced by the global demand for commodities, particularly oil. |

| Central Bank Influence | The Bank of Canada plays a significant role in managing the Canadian dollar's value through interest rate policies. |

| Cross-Border Trade | The Canadian dollar's proximity to the United States and the high volume of cross-border trade can affect its value. |

Continue reading to delve deeper into the intricacies of the Canadian dollar, including market trends, investment strategies, and expert perspectives.

FAQ

This comprehensive FAQ section aims to address common queries and misconceptions regarding the Canadian dollar, providing clarity and insights for informed investment decisions.

Value investing in India - An Ultimate Guide for Value Stock Pickers! - Source tradebrains.in

Question 1: What are the key factors influencing the value of the Canadian dollar?

The value of the Canadian dollar is primarily influenced by:

- Economic performance, including GDP growth, inflation, and interest rates.

- Commodity prices, particularly oil and other natural resources.

- Monetary policy decisions by the Bank of Canada.

- Global economic conditions, including currency movements and economic sentiment.

- Political and social factors that may impact investor confidence.

Question 2: How can investors gain exposure to the Canadian dollar?

There are various ways to invest in the Canadian dollar, including:

- Spot forex trading

- Currency futures and options

- Exchange-traded funds (ETFs) that track the Canadian dollar's value

- Investing in Canadian bonds or stocks

Question 3: What are the potential risks involved in investing in the Canadian dollar?

Investing in the Canadian dollar carries certain risks, including:

- Currency fluctuations: The value of the Canadian dollar can fluctuate significantly, resulting in potential losses.

- Interest rate risk: Changes in Canadian interest rates can affect the value of Canadian dollar investments.

- Economic risks: Economic downturns or unexpected events can negatively impact the value of the Canadian dollar.

- Political risks: Political instability or policy changes in Canada can affect investor confidence and currency value.

Question 4: How can investors mitigate risks when investing in the Canadian dollar?

To mitigate risks, investors can consider the following strategies:

- Diversification: Spreading investments across different currencies and asset classes.

- Hedging strategies: Using financial instruments to offset potential losses from currency fluctuations.

- Long-term investments: Holding Canadian dollar investments over a longer period can reduce the impact of short-term fluctuations.

- Regular monitoring: Keeping a close eye on economic indicators and market conditions to make informed investment decisions.

Question 5: What is the long-term outlook for the Canadian dollar?

The long-term outlook for the Canadian dollar is generally positive, supported by a strong economy, sound monetary policy, and abundant natural resources. However, fluctuations in global economic conditions and commodity prices can affect the currency's value.

Question 6: Is investing in the Canadian dollar a suitable strategy for all investors?

The suitability of investing in the Canadian dollar depends on individual investment goals, risk tolerance, and time horizon. Investors considering exposure to the Canadian dollar should carefully assess their own financial situation and seek professional advice if necessary.

By understanding these key points and addressing common concerns, investors can make informed decisions about whether and how to incorporate the Canadian dollar into their portfolios.

To delve deeper into the complexities of the Canadian dollar, explore our next article section.

Tips

To achieve the objectives of this article, here are several tips that can help you understand and invest in the Canadian Dollar effectively:

Tip 1: Learn about the history and fundamentals of the Canadian Dollar. The Ultimate Guide To Understanding And Investing In The Canadian Dollar is an in-depth resource that provides valuable insights into the historical performance, economic factors, and global influences that shape the Canadian Dollar's value.

Tip 2: Monitor economic data for insights. Key economic indicators, such as GDP growth, inflation, and employment statistics, can provide valuable information on the health of the Canadian economy and its potential impact on the Canadian Dollar.

Tip 3: Understand the influence of global events. Global economic conditions and political events can have a significant impact on the value of the Canadian Dollar. Stay informed about major happenings worldwide to make informed investment decisions.

Tip 4: Diversify your investments. Investing in the Canadian Dollar should be part of a diversified investment portfolio that includes various assets, such as stocks, bonds, and real estate. This approach can help mitigate risks and enhance overall returns.

Tip 5: Consider investing in Canadian Dollar-denominated assets. If you are bullish on the Canadian Dollar's prospects, consider investing in assets denominated in this currency, such as Canadian bonds, stocks, or real estate. This strategy can provide exposure to potential currency appreciation.

Tip 6: Seek professional guidance. If you are new to currency investing or need personalized advice, consider consulting with a financial advisor who specializes in the Canadian Dollar. They can provide tailored recommendations based on your investment objectives and risk tolerance.

Tip 7: Stay informed about market trends. Regularly monitor financial news and analysis to stay abreast of the latest developments affecting the Canadian Dollar. This knowledge can help you make informed decisions and adjust your investment strategy accordingly.

Tip 8: Be patient and disciplined. Currency investing can be subject to volatility and market fluctuations. Exercise patience and maintain a disciplined approach to achieve long-term success. Avoid making impulsive decisions and stick to a well-defined investment plan.

The Ultimate Guide to Turnkey Real Estate Investing: What It Is and How - Source www.sweetcaptcha.com

By following these tips, you can enhance your understanding of the Canadian Dollar and make informed investment decisions that align with your financial goals.

Remember, investing in any financial instrument involves a level of risk. Before making any investment decisions, it is crucial to conduct thorough research, assess your risk tolerance, and consult with financial professionals if necessary.

The Ultimate Guide To Understanding And Investing In The Canadian Dollar

Understanding the Canadian dollar is crucial for global investors due to its stability, economic indicators, and international trade significance. This guide explores six key aspects:

- Economic Indicators: GDP, inflation, employment

- Reserve Currency: Role in global transactions

- Commodity Correlation: Link to oil and gold prices

- Central Bank Policy: Impact of interest rates and quantitative easing

- Exchange Rate Dynamics: USD/CAD relationship, geopolitical factors

- Investment Opportunities: Bonds, stocks, ETFs, currency trading

The Canadian dollar's fluctuations are influenced by the Bank of Canada's monetary policy, global economic conditions, and commodity prices. Recognizing these aspects empowers investors to make informed decisions. Currency trading, for instance, presents opportunities to capitalize on short-term fluctuations, while long-term investments in Canadian assets can provide stability and potential growth.

The Ultimate Guide to Investing in Cryptocurrency: Tips for Beginners - Source www.whatmattered.com

The Ultimate Guide To Understanding And Investing In The Canadian Dollar

The Canadian dollar, also known as the loonie, is the official currency of Canada. It is the fifth most traded currency in the world, and it is often used as a safe haven asset during times of economic uncertainty. The Canadian dollar is also a popular currency for investment, and there are a number of factors that can affect its value. These factors include the price of oil, the interest rate differential between Canada and the United States, and the global economic outlook.

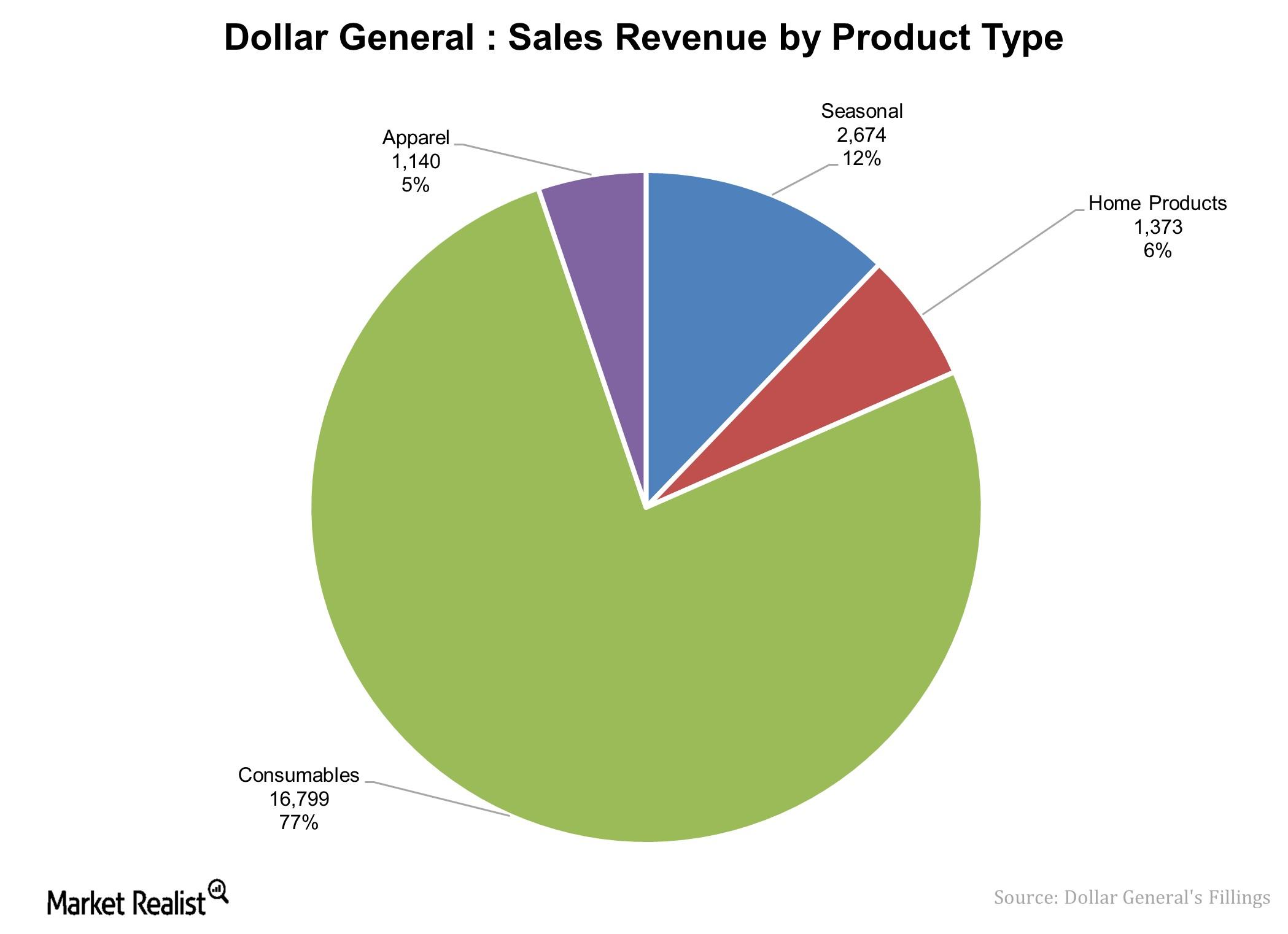

Understanding Dollar General’s Key Product Offerings - Source marketrealist.com

Understanding the factors that affect the Canadian dollar is essential for anyone who wants to invest in the currency. By understanding these factors, investors can make informed decisions about when to buy and sell the Canadian dollar, and they can potentially maximize their returns.

In addition to the factors mentioned above, there are a number of other factors that can affect the Canadian dollar. These factors include:

| Factor | Effect on Canadian dollar |

|---|---|

| Price of gold | A rise in the price of gold can lead to a rise in the Canadian dollar, as Canada is a major producer of gold. |

| Political stability | Political instability in Canada can lead to a decline in the Canadian dollar, as investors become less confident in the country's economic future. |

| Natural disasters | Natural disasters in Canada can lead to a decline in the Canadian dollar, as investors become concerned about the country's economic recovery. |

By understanding the factors that affect the Canadian dollar, investors can make informed decisions about when to buy and sell the currency.