Hajj, the sacred pilgrimage to Makkah, is an extraordinary spiritual journey that holds profound significance for Muslims worldwide. But embarking on this journey can be financially demanding, requiring careful planning and saving. Recognizing the need for guidance, "The Ultimate Guide To Hajj Savings: Empowering Your Pilgrimage Journey" offers a comprehensive resource for aspiring pilgrims seeking to make their pilgrimage aspirations a reality.

Editor's Note: "The Ultimate Guide To Hajj Savings: Empowering Your Pilgrimage Journey" has been recently published to assist aspiring pilgrims in navigating the financial aspects of the Hajj.

Through meticulous analysis and extensive research, "The Ultimate Guide To Hajj Savings: Empowering Your Pilgrimage Journey" provides valuable insights, practical advice, and tailored strategies to help readers plan and save effectively.

hajj savings islamic pilgrimage illustration 23233970 Vector Art at - Source www.vecteezy.com

FAQ

This section aims to address frequently asked questions that can arise during the planning and execution of your Hajj savings journey.

A Brief Guide to Hajj (Poster) - Source www.newmuslim.net

Question 1: What is the optimal saving period for the Hajj?

Ideally, a saving period of 5-10 years is recommended to accumulate the necessary funds gradually and minimize financial strain.

Question 2: How much should I aim to save each month?

The monthly savings amount will vary based on the total Hajj cost. However, a general recommendation is to save around 5-10% of your monthly income, or more if possible.

Question 3: Are there any tax benefits or government assistance programs available for Hajj savings?

Tax benefits and government assistance programs for Hajj savings vary depending on the country of residence. It is advisable to research local regulations and explore potential financial support options.

Question 4: What investment options should I consider for my Hajj savings?

Consider a diversified portfolio that includes a mix of low-risk and high-yield investments. Options such as mutual funds, bonds, and real estate can provide a balance of stability and potential growth.

Question 5: How can I stay motivated throughout my Hajj savings journey?

Set realistic saving goals, track your progress, and surround yourself with a supportive community. Regularly remind yourself of the significance of the Hajj and the importance of financial preparation.

Question 6: What if I face financial difficulties during my savings journey?

Unexpected financial setbacks can occur. Explore options such as adjusting your savings plan, seeking financial assistance from family or friends, or considering additional income streams to maintain your saving momentum.

Meticulous planning, discipline, and unwavering determination are key to a successful Hajj savings journey. By addressing common concerns and providing practical guidance, we aim to empower you in fulfilling your pilgrimage aspirations.

Proceed to the next section to explore expert tips and strategies for maximizing your Hajj savings.

Tips for Saving and Planning for a Meaningful Hajj Pilgrimage

Hajj is an incredibly rewarding spiritual experience, but it can also be a significant financial undertaking. To help make your pilgrimage more accessible, we present some proven strategies for saving and planning wisely.

Tip 1: Plan in Advance

Starting your financial preparations well in advance allows you to spread the costs over a longer period, making the goal more manageable.

Tip 2: Seek Guidance from Experts

Consult with experienced travel agencies or pilgrimage organizers who can guide you through the process, helping you avoid unnecessary expenses and ensuring a smooth journey.

Tip 3: Explore Group Discounts

Traveling with a reputable Hajj group can offer significant savings on accommodations, transportation, and other services, maximizing your financial resources.

Tip 4: Consider Budget-Friendly Options

Explore cost-effective accommodation, such as shared rooms or guesthouses, and look for package deals that include meals and transportation to reduce overall expenses.

Tip 5: Save Smartly

Set up a dedicated savings account and automate regular deposits to consistently build your pilgrimage fund. Consider exploring investment options that align with your financial goals.

Tip 6: Utilize Technology

Leverage online tools and mobile apps to compare flight prices, book accommodations, and stay updated on budget-friendly options.

Tip 7: Seek Financial Assistance

Explore organizations that provide financial aid to pilgrims with limited means. Research and apply for grants or scholarships that can supplement your savings.

By following these tips, you can empower yourself for a meaningful and financially responsible Hajj pilgrimage. With careful planning and a commitment to saving, you can turn the journey of a lifetime into a reality.

For more insights and practical advice on Hajj savings, refer to The Ultimate Guide To Hajj Savings: Empowering Your Pilgrimage Journey.

The Ultimate Guide To Hajj Savings: Empowering Your Pilgrimage Journey

Empowering your Hajj pilgrimage journey requires meticulous planning, and financial preparation is paramount. This guide unveils essential aspects to guide you in saving effectively for a fulfilling and enriching spiritual experience.

- Budgeting: Estimate expenses, prioritize needs, and allocate funds accordingly.

- Savings Plan: Establish a structured savings plan with realistic goals and timelines.

- Investment Options: Explore investment options like mutual funds or bonds to maximize savings growth.

- Cutting Expenses: Identify non-essential expenses and make prudent cutbacks to free up more funds.

- Additional Income: Consider part-time work or monetizing skills to supplement your savings.

- Hajj Savings Accounts: Utilize dedicated savings accounts with competitive rates to optimize your savings.

Through diligent implementation of these key aspects, you can empower your Hajj savings journey. By budgeting wisely, investing strategically, and exploring additional income streams, you can ensure a financially secure pilgrimage that allows you to focus on the spiritual significance of this once-in-a-lifetime experience.

Pilgrimage: Start your journey - Source www.spelspul.nl

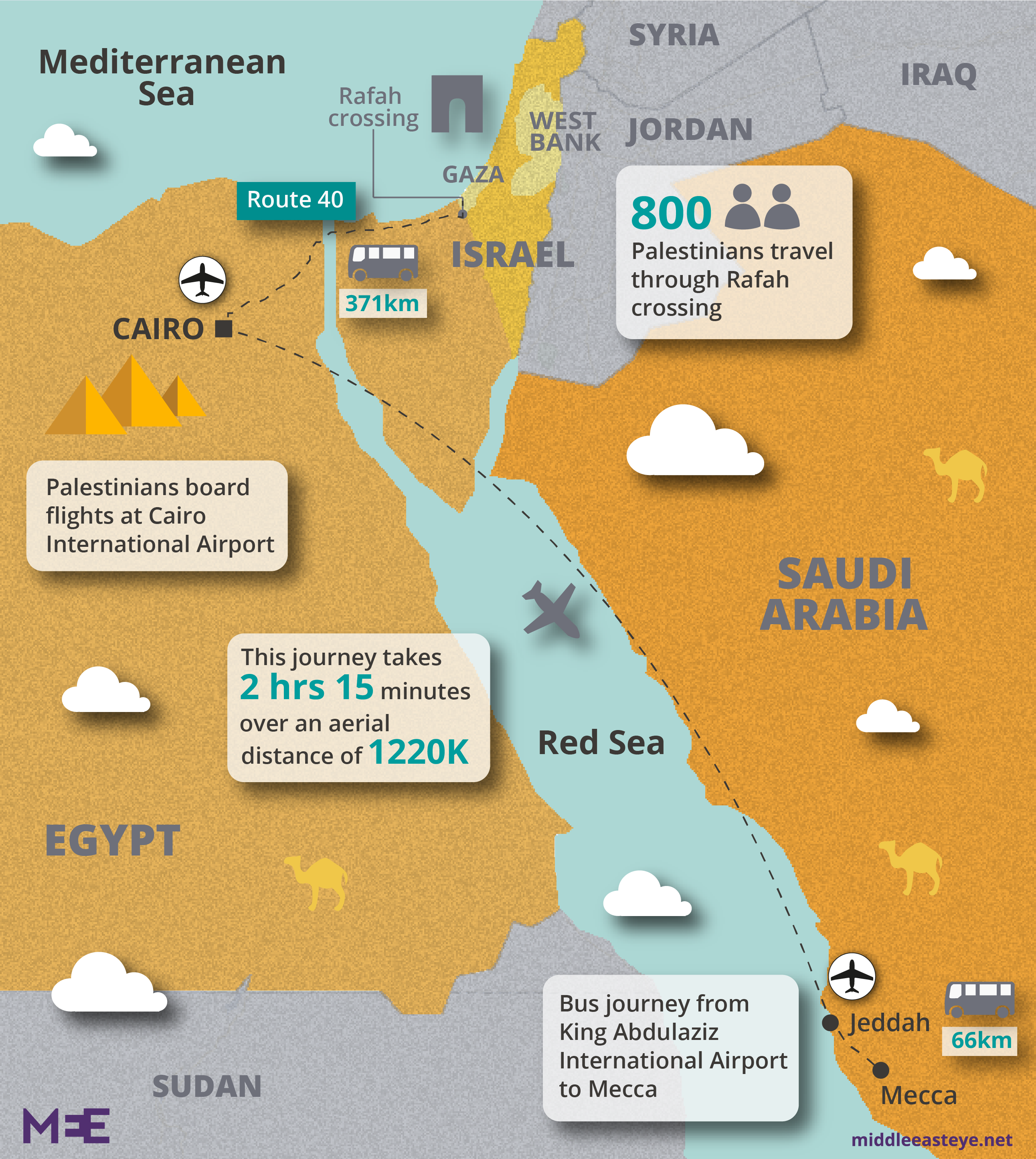

Hajj Journey Map - Source mavink.com

The Ultimate Guide To Hajj Savings: Empowering Your Pilgrimage Journey

This guide serves as a comprehensive resource for individuals seeking to embark on the sacred journey of Hajj without the financial burdens. It offers a systematic approach to planning and saving, empowering pilgrims to overcome the financial challenges associated with this significant religious obligation.

Hajj Pilgrimage Map - Source mungfali.com

The importance of financial planning for Hajj cannot be underestimated. The pilgrimage involves substantial expenses, including travel, accommodation, and rituals. By effectively managing their finances, pilgrims can ensure a fulfilling and worry-free pilgrimage experience.

The guide provides practical advice on budgeting, setting realistic savings goals, and exploring various income-generating opportunities. It also highlights the significance of seeking financial assistance from charitable organizations and community support programs, ensuring that financial constraints do not hinder the spiritual journey.

The guide empowers pilgrims with the knowledge and tools to make informed financial decisions throughout their savings journey. It encourages a disciplined approach to budgeting, promotes responsible spending habits, and provides ongoing support and motivation.

Conclusion

The Ultimate Guide To Hajj Savings: Empowering Your Pilgrimage Journey serves as a valuable resource for aspiring pilgrims, providing a comprehensive roadmap to financial preparedness. By embracing the strategies outlined in this guide, individuals can overcome the financial hurdles associated with Hajj and embark on a spiritually enriching pilgrimage.

The guide highlights the transformative power of financial planning, empowering pilgrims to pursue their religious obligations with financial confidence. Through responsible saving and prudent budgeting, individuals can ensure a fulfilling and meaningful Hajj experience.