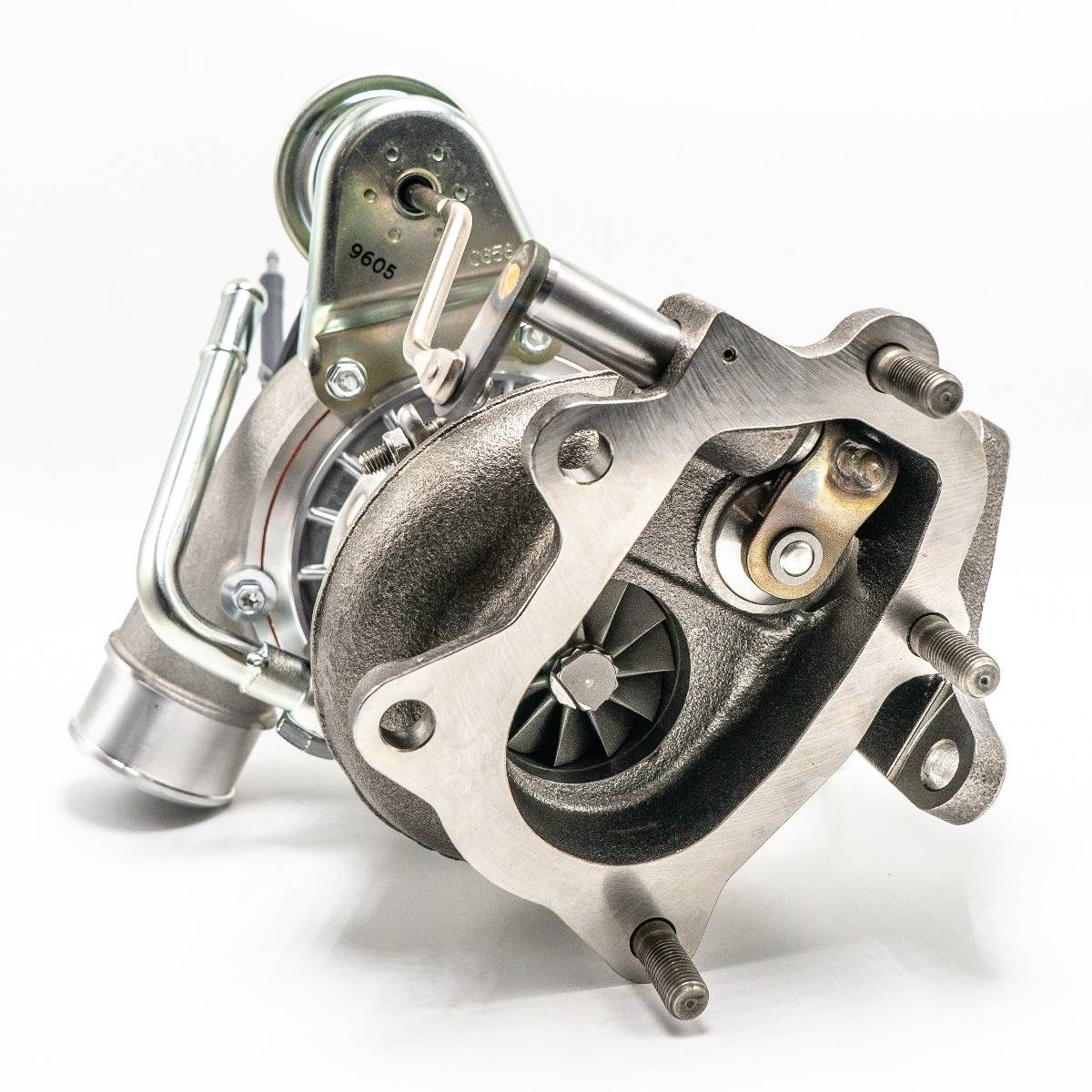

IHI PERFORMANCE VF48 HIGH FLOW TURBO UPGRADE - 04-21 STI AND 02-07 WRX - Source subiesupplyco.ca

Key differences or Key takeways, provide in informative table format

Transition to main article topics

FAQ

This FAQ section provides concise answers to common questions and addresses potential concerns or misconceptions regarding IHI's recent stock performance and analysis.

IHI Corporation, Rotated Logo, White Background Stock Photo - Alamy - Source www.alamy.com

Question 1: Why has IHI's stock price fluctuated significantly in recent months?

Answer: IHI's stock price has experienced volatility due to various factors, including global economic uncertainties, industry-specific challenges, and company-specific developments.

Question 2: What are the key drivers behind IHI's recent financial performance?

Answer: IHI's financial performance has been influenced by factors such as changes in demand for its products and services, cost optimization initiatives, and strategic acquisitions or divestments.

Question 3: How does IHI's recent stock performance compare to its peers?

Answer: IHI's stock performance should be evaluated in the context of its industry peers. Comparisons can provide insights into the company's competitive position and relative valuation.

Question 4: What are the potential risks and opportunities associated with investing in IHI?

Answer: Investing in IHI involves both risks and opportunities. Risks may include economic downturns, technological disruption, and competitive pressures. Opportunities may include growth potential in emerging markets, innovation in product offerings, and strategic partnerships.

Question 5: How should investors interpret the recent analyst recommendations for IHI?

Answer: Analyst recommendations should be considered in the context of their research methodologies. It is important to understand the rationale behind recommendations and to diversify investments based on individual risk tolerance and financial goals.

Question 6: What is the long-term outlook for IHI's stock performance?

Answer: Determining the long-term outlook for IHI's stock performance involves assessing factors such as industry trends, competitive dynamics, and the company's strategic vision. It is important to conduct thorough research and consult with financial professionals before making investment decisions.

This FAQ section aims to provide a comprehensive overview of key questions related to IHI's recent stock performance and analysis. However, it is recommended to consult with qualified financial advisors for personalized advice and to make informed investment decisions based on individual circumstances and risk tolerance.

Proceed to the next section for a deeper analysis of IHI's financial performance and market outlook.

Tips by "IHI: Recent Stock Performance And Analysis"

This article provides valuable insights into the recent stock performance and analysis of IHI Corporation. By following these recommended tips, investors and analysts can make informed decisions and better understand the company's current standing and future prospects.

Tip 1: Monitor key financial metrics

Keep track of IHI's revenue, earnings per share (EPS), and profit margin. These metrics provide a snapshot of the company's financial health and ability to generate profits.

Tip 2: Explore IHI's industry position

Understand IHI's market share, competitive landscape, and industry trends. This information helps assess the company's position within its sector and identify potential growth opportunities or challenges.

Tip 3: Evaluate IHI's management

Research the experience and track record of IHI's management team. A strong management team with a clear vision and execution capabilities is crucial for the company's long-term success.

Tip 4: IHI: Recent Stock Performance And Analysis

Stay informed about IHI's recent stock performance. This includes monitoring its share price movement, trading volume, and analyst ratings. Understanding market sentiment can provide valuable insights into the company's outlook.

Tip 5: Consider potential risks

Identify potential risks that could impact IHI's business, such as economic downturns, regulatory changes, or technological advancements. Assessing these risks helps investors make informed decisions and mitigate potential losses.

Summary

By following these tips, investors and analysts can gain a deeper understanding of IHI Corporation's stock performance and analysis. This knowledge empowers them to make informed investment decisions and assess the company's future prospects.

IHI: Recent Stock Performance And Analysis

Investors seeking to understand the recent stock performance of IHI Corporation will find value in examining key aspects that have influenced the company's share price. These include its financial results, industry trends, and overall market conditions.

- Financial Results: IHI's revenue and earnings have shown positive growth in recent quarters.

- Industry Trends: The aerospace and shipbuilding sectors, in which IHI operates, have experienced strong demand.

- Market Conditions: Favorable economic conditions and low interest rates have supported stock prices.

- Technical Analysis: IHI's stock price has broken above key resistance levels, indicating bullish sentiment.

- Valuation Metrics: IHI's price-to-earnings ratio is currently below industry averages, suggesting potential undervaluation.

- Dividend Yield: IHI pays a stable dividend, providing income for investors.

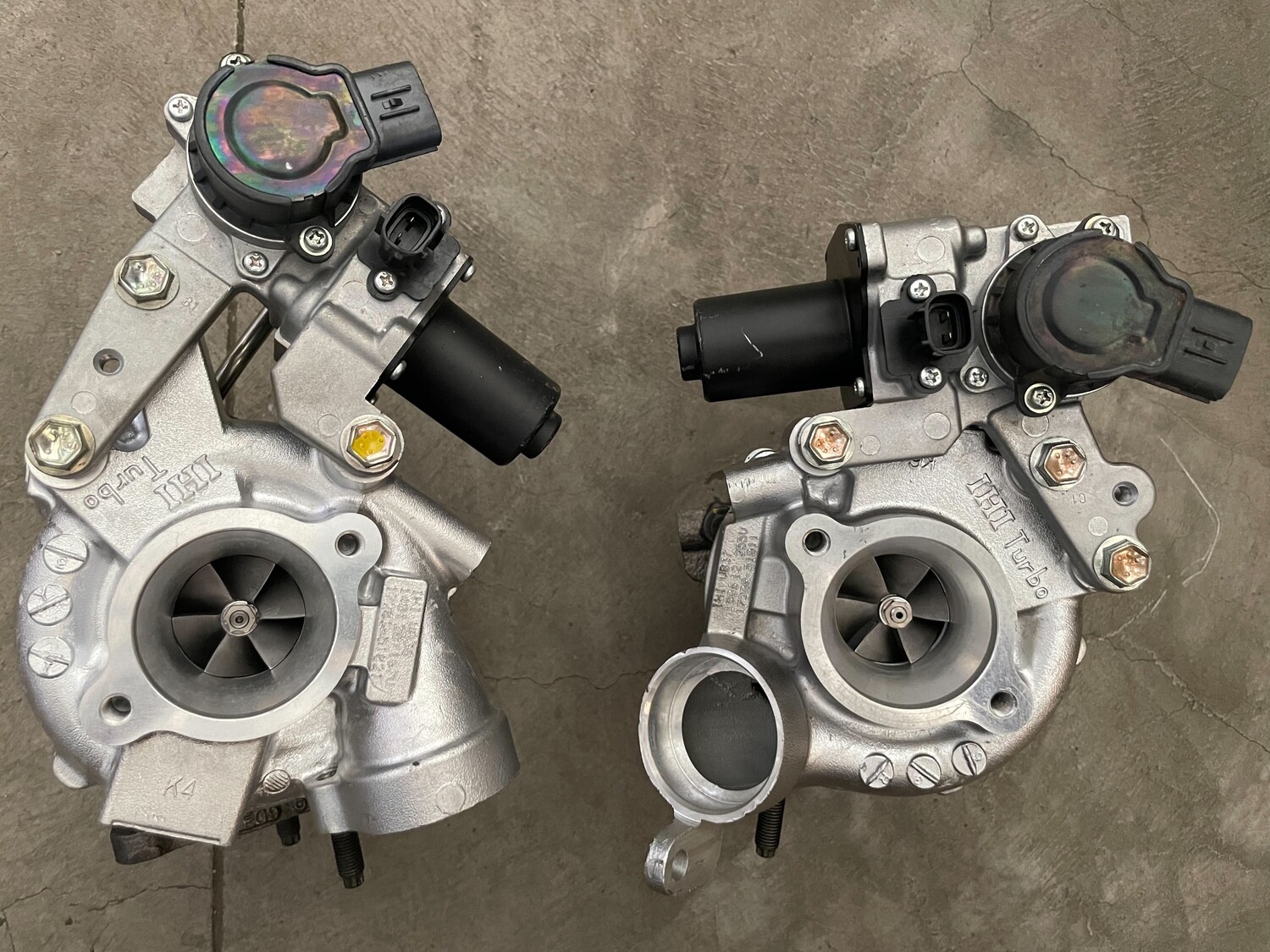

Genuine IHI Turbo for TOYOTA 1VD-FTV V8 Twin Turbo IHI VB36 17201-51021 - Source www.fortranperformance.com

In conclusion, IHI's recent stock performance reflects the company's strong financial performance, favorable industry dynamics, and positive market sentiment. Technical analysis suggests further upside potential, while valuation metrics indicate potential undervaluation. Investors should carefully consider these aspects when evaluating IHI's stock as a potential investment.

IHI: Recent Stock Performance And Analysis

IHI Corporation (IHI) is a leading Japanese heavy industry manufacturer. Its recent stock performance has been mixed, with the company facing challenges in its core businesses and the broader economic environment. However, IHI's long-term prospects remain positive, driven by its strong market position, diversified product portfolio, and commitment to innovation.

How to read stock charts-Learn Stock trading-Best Stock Charts - Source fitzstock.com

In the past year, IHI's stock price has declined by approximately 15%, underperforming the broader Japanese stock market. This decline has been attributed to a number of factors, including:

- Weakening demand for IHI's products, particularly in the shipbuilding and construction sectors.

- Increased competition from domestic and international rivals.

- Rising costs of raw materials and labor.

Despite these challenges, IHI's long-term prospects remain positive. The company has a strong market position in its core businesses, and it is well-positioned to benefit from the growing demand for infrastructure and energy solutions in Asia and other emerging markets. IHI is also committed to innovation, and it is investing heavily in research and development to develop new products and technologies.

IHI's recent stock performance has been mixed, but the company's long-term prospects remain positive. Investors should consider IHI's strong market position, diversified product portfolio, and commitment to innovation when making investment decisions.

Key Insights:

| Factor | Insight |

| Recent stock performance | Mixed, with a 15% decline in the past year |

| Challenges | Weakening demand, increased competition, rising costs |

| Long-term prospects | Positive, driven by strong market position, diversified portfolio, and commitment to innovation |