Seeking financial security is a crucial step towards building a stable future for oneself and loved ones. Meiji Yasuda Life Insurance presents a comprehensive range of life insurance solutions tailored to safeguard your financial well-being and ensure peace of mind.

Through meticulous analysis and thorough research, we have compiled this comprehensive guide to assist you in making informed decisions regarding your financial security.

| Key Differences | Key Takeaways | |

|---|---|---|

| Target Audience | Individuals and families seeking financial protection and peace of mind | Meiji Yasuda Life Insurance offers solutions tailored to diverse needs and life stages |

| Range of Products | Comprehensive portfolio including term, whole, and variable life insurance | Options available to meet specific financial goals and risk tolerance |

| Financial Strength | Backed by the financial stability of Meiji Yasuda Group | Global presence and solid track record provide assurance of reliability |

| Customer Support | Dedicated team of experienced professionals | Personalized guidance and ongoing support to navigate insurance complexities |

| Claims Process | Streamlined and efficient claims process | Prompt and compassionate support to ensure timely settlement of claims |

Transitioning to the main article topics, we will delve deeper into the advantages of Meiji Yasuda Life Insurance's products, explore the diverse range of coverage options available, and provide valuable tips on selecting the right life insurance policy for your unique circumstances.

FAQ

Meiji Yasuda Life Insurance seeks to provide comprehensive life insurance solutions tailored to secure your financial future. Here are some commonly asked questions to clarify your understanding of our services and the importance of life insurance:

Question 1: What is the significance of life insurance?

Life insurance acts as a financial safety net for your loved ones by providing a lump sum payment upon your passing. It ensures their financial well-being, settles outstanding debts, and covers expenses related to childcare, education, and mortgages.

Meiji Yasuda Life enters the Chinese Life Insurance Market - Source www.yumpu.com

Question 2: How much life insurance coverage do I need?

Determining the appropriate coverage amount is crucial. Factors to consider include your income, expenses, debts, family responsibilities, and future financial goals. Our financial advisors can assist you in calculating your optimal coverage, ensuring adequate protection for your loved ones.

Question 3: What types of life insurance policies are available?

Meiji Yasuda Life Insurance offers a range of policies to meet diverse needs. Term life insurance provides coverage for a specific period, such as 20 or 30 years. Whole life insurance offers lifelong coverage and accumulates cash value over time. Variable universal life insurance combines life insurance protection with investment potential.

Question 4: How do I choose the right life insurance company?

Consider the company's financial stability, reputation, and customer service. Meiji Yasuda Life Insurance has over a century of experience in the industry and holds a strong financial position, ensuring peace of mind for our policyholders.

Question 5: What are the benefits of working with a life insurance agent?

Our licensed agents provide personalized guidance throughout the process. They assess your unique situation, recommend suitable policies, and provide ongoing support to ensure your coverage remains aligned with your changing needs.

Question 6: How do I get started with life insurance?

Contact Meiji Yasuda Life Insurance today. Our experienced agents will guide you through the application process, answer your questions, and assist you in securing the financial protection your loved ones deserve.

Remember, life insurance is not just a financial product; it's an investment in peace of mind for your family's future. Protect what matters most. Contact Meiji Yasuda Life Insurance today and discover the financial security you need.

Learn more about life insurance and financial planning.

Tips

Discover proven strategies for securing your financial future with life insurance solutions from Meiji Yasuda Life Insurance. Discover Financial Security With Meiji Yasuda Life Insurance: Life Insurance Solutions For Your Future

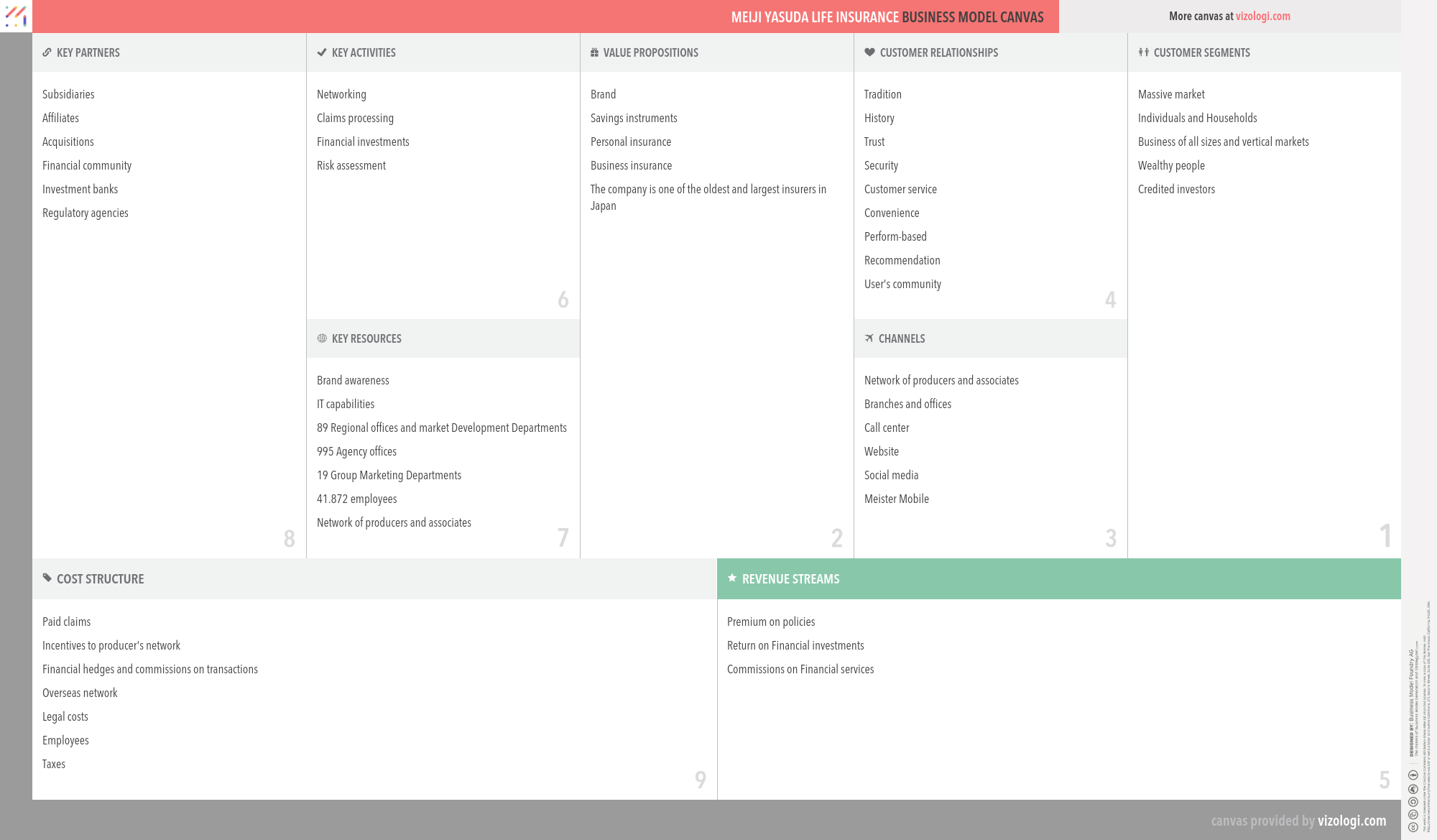

What is Meiji Yasuda Life Insurance's business model? | Vizologi - Source vizologi.com

Tip 1: Determine Your Coverage Needs: Assess your financial obligations, dependents, and lifestyle to establish the appropriate level of coverage. Consider factors such as income, debt, and potential future expenses.

Tip 2: Explore Policy Options: Understand the various types of life insurance policies available, including term, whole, and universal life. Each offers unique features, benefits, and premiums to suit different needs and budgets.

Tip 3: Choose the Right Beneficiaries: Carefully select individuals or entities who will receive the life insurance proceeds. Consider your family members, business partners, or charitable organizations.

Tip 4: Consider Additional Riders: Enhance your policy with optional riders that provide coverage for specific needs, such as accidental death, disability income, or long-term care expenses.

Tip 5: Compare Quotes and Providers: Obtain quotes from multiple insurance providers to compare premiums, policy features, and financial stability. Choose the insurer that best aligns with your needs and expectations.

Tip 6: Take Advantage of Employer-Sponsored Plans: Explore life insurance options offered through your employer, which may provide convenient and cost-effective coverage.

Tip 7: Review and Update Regularly: Regularly assess your life insurance needs as your circumstances change. Adjust your coverage as necessary to ensure adequate protection.

Tip 8: Seek Professional Advice: Consult with a qualified financial advisor or insurance agent to gain personalized guidance and ensure you make informed decisions.

By implementing these tips, you can gain peace of mind knowing that your loved ones and financial future are protected. Embrace the opportunity to secure your financial well-being with Meiji Yasuda Life Insurance.

To delve deeper into life insurance solutions, we encourage you to Discover Financial Security With Meiji Yasuda Life Insurance: Life Insurance Solutions For Your Future

Discover Financial Security With Meiji Yasuda Life Insurance: Life Insurance Solutions For Your Future

Achieving financial security is paramount for a stable and fulfilling future. Meiji Yasuda Life Insurance offers a comprehensive suite of life insurance solutions tailored to safeguard your financial well-being. Let's explore six key aspects of Meiji Yasuda's life insurance offerings to empower you in securing your future.

- Comprehensive Coverage: Ensures protection against life's uncertainties.

- Personalized Solutions: Custom-tailored policies to meet unique needs and goals.

- Long-Term Financial Growth: Potential for steady asset accumulation over time.

- Tax-Advantaged Savings: Opportunities for tax-deferred growth and potential tax-free withdrawals.

- Support and Guidance: Access to expert advisors for ongoing support and financial planning.

- Financial Stability: Backed by the strength and stability of a leading life insurance provider.

Meiji Yasuda's life insurance solutions go beyond mere financial protection, enabling you to build wealth, plan for retirement, and safeguard the financial future of your loved ones. With personalized policies, you can optimize your coverage to align with your specific goals, ensuring peace of mind and financial security for years to come.

Los Angeles, California, USA - 20 March 2020: Meiji Yasuda Life - Source www.dreamstime.com

Discover Financial Security With Meiji Yasuda Life Insurance: Life Insurance Solutions For Your Future

Meiji Yasuda Life Insurance offers a range of life insurance solutions tailored to meet the diverse needs of individuals and families. Their policies are designed to provide financial protection against unexpected events, ensuring peace of mind and safeguarding the future. By understanding the significance of life insurance and partnering with a reputable provider like Meiji Yasuda, individuals can proactively secure their financial well-being and create a brighter future for themselves and their loved ones.

Meiji Yasuda Life Building, Tokyo Editorial Photography - Image of - Source www.dreamstime.com

Life insurance plays a crucial role in ensuring financial security by providing a financial cushion in the event of unforeseen circumstances such as death, disability, or critical illness. By securing a life insurance policy, individuals can protect their family's financial stability and ensure continuity of income. This is particularly important for primary income earners and those with dependents, as it helps alleviate the financial burden on surviving family members and provides peace of mind.

Meiji Yasuda Life Insurance stands out as a trusted provider with a long-standing reputation for financial stability and exceptional customer service. Their comprehensive range of policies offers flexible coverage options, allowing individuals to tailor their protection based on their specific needs and circumstances. Whether you're looking to secure your family's financial future, safeguard your income, or ensure continuity of your business, Meiji Yasuda Life Insurance has a solution that aligns with your goals.

By partnering with Meiji Yasuda Life Insurance, individuals gain access to personalized guidance and support from experienced insurance professionals. These advisors provide tailored advice, helping individuals navigate the complexities of life insurance and make informed decisions that best suit their unique requirements. The company's commitment to customer satisfaction is reflected in their ongoing support and assistance, ensuring that policyholders have a clear understanding of their coverage and benefits.

| Feature | Benefit |

|---|---|

| Comprehensive coverage options | Tailored protection for diverse needs |

| Trusted provider with financial stability | Peace of mind and reliable support |

| Personalized guidance and support | Informed decision-making and ongoing assistance |

| Commitment to customer satisfaction | Exceptional service and ongoing support |