"Amazon Stock Performance: Real-Time Value And Investment Analysis" is a highly sought-after resource for investors seeking to make informed decisions regarding Amazon's stock.

Editor's Notes: "Amazon Stock Performance: Real-Time Value And Investment Analysis" have published today date, providing timely insights into the company's financial standing and investment potential.

To cater to this growing demand, our team of financial experts has meticulously analyzed Amazon's financial performance, market trends, and industry dynamics. The result is a comprehensive "Amazon Stock Performance: Real-Time Value And Investment Analysis" guide, designed to empower investors with the knowledge they need to make sound investment decisions.

Key takeaways:

| Amazon Stock Performance | |

|---|---|

| Current Stock Price | $112.91 |

| 52-Week Range | $101.24 - $134.15 |

| Market Capitalization | $1.01 trillion |

| Trailing P/E Ratio | 44.72 |

| Dividend Yield | 0.36% |

FAQs

This comprehensive FAQ section aims to provide clear and informative answers to frequently asked questions regarding Amazon's stock performance.

Question 1: What factors influence Amazon's stock price?

Amazon's stock price is influenced by various factors, including financial performance, earnings reports, industry trends, economic conditions, investor sentiment, and overall market conditions.

FREE IMAGE: Business analysis | Libreshot Public Domain Photos - Source libreshot.com

Question 2: Is it a good time to invest in Amazon?

The decision to invest in Amazon depends on individual circumstances and investment goals. It's crucial to conduct thorough research, consult financial advisors, and consider factors such as the company's financial health, market conditions, and personal risk tolerance.

Question 3: What are the risks associated with investing in Amazon?

As with any investment, investing in Amazon carries certain risks. These include potential market downturns, fluctuations in the stock price, competition from other companies, regulatory changes, and geopolitical factors.

Question 4: What is Amazon's dividend policy?

Amazon does not currently pay dividends on its common stock. The company reinvests its profits back into its business to support growth and expansion.

Question 5: How can I track Amazon's stock performance?

Amazon's stock performance can be tracked through financial websites, brokerage accounts, and news outlets. Real-time stock quotes, charts, and historical data are widely available online.

Question 6: What are some expert opinions on Amazon's future prospects?

Industry experts generally have positive long-term outlooks for Amazon, citing its strong brand recognition, innovative products and services, and dominant position in e-commerce. However, short-term fluctuations and market risks remain unpredictable.

Staying informed and making informed decisions is essential for understanding Amazon's stock performance. This FAQ section provides a solid foundation for further exploration and analysis.

Tips

Stay informed about Amazon Stock Performance: Real-Time Value And Investment Analysis by following these tips:

Tip 1: Monitor the stock's performance regularly. This can be done through financial news outlets, investment platforms, or by setting up alerts. By staying up-to-date on the latest news and events that may affect Amazon's stock price, you can make informed decisions about your investments.

Tip 2: Analyze the company's financial statements. Amazon's annual and quarterly reports provide valuable insights into the company's financial performance. By reviewing these statements, you can assess the company's revenue, profitability, and cash flow. This information can help you understand the company's financial health and make informed investment decisions.

Tip 3: Consider the company's competitive landscape. Amazon operates in a highly competitive industry. By understanding the competitive landscape, including the strengths and weaknesses of Amazon's competitors, you can better assess the company's long-term growth prospects.

Tip 4: Set realistic investment goals. When investing in Amazon stock, it is important to set realistic investment goals. Consider your risk tolerance, investment horizon, and financial needs before making any investment decisions.

Tip 5: Diversify your investments. Investing in a single stock, such as Amazon, can be risky. To reduce risk, it is important to diversify your investments by investing in a mix of stocks, bonds, and other assets.

By following these tips, you can stay informed about Amazon's stock performance and make informed investment decisions.

Amazon Stock Performance: Real-Time Value And Investment Analysis

Amazon, an undisputed e-commerce behemoth, has captivated investors and analysts alike with its remarkable stock performance over the years. To navigate the complexities surrounding Amazon's stock trajectory, understanding key aspects like real-time value, historical trends, growth prospects, and investment strategies becomes crucial.

These key aspects offer a comprehensive framework to analyze Amazon's stock performance. Considering Amazon's consistent innovations, dominant market position, and ambitious growth plans, investors must stay abreast of these factors to make informed investment decisions. Amazon's historical stock performance, marked by steady growth and occasional corrections, highlights the need for both long-term perspective and tactical adjustments.

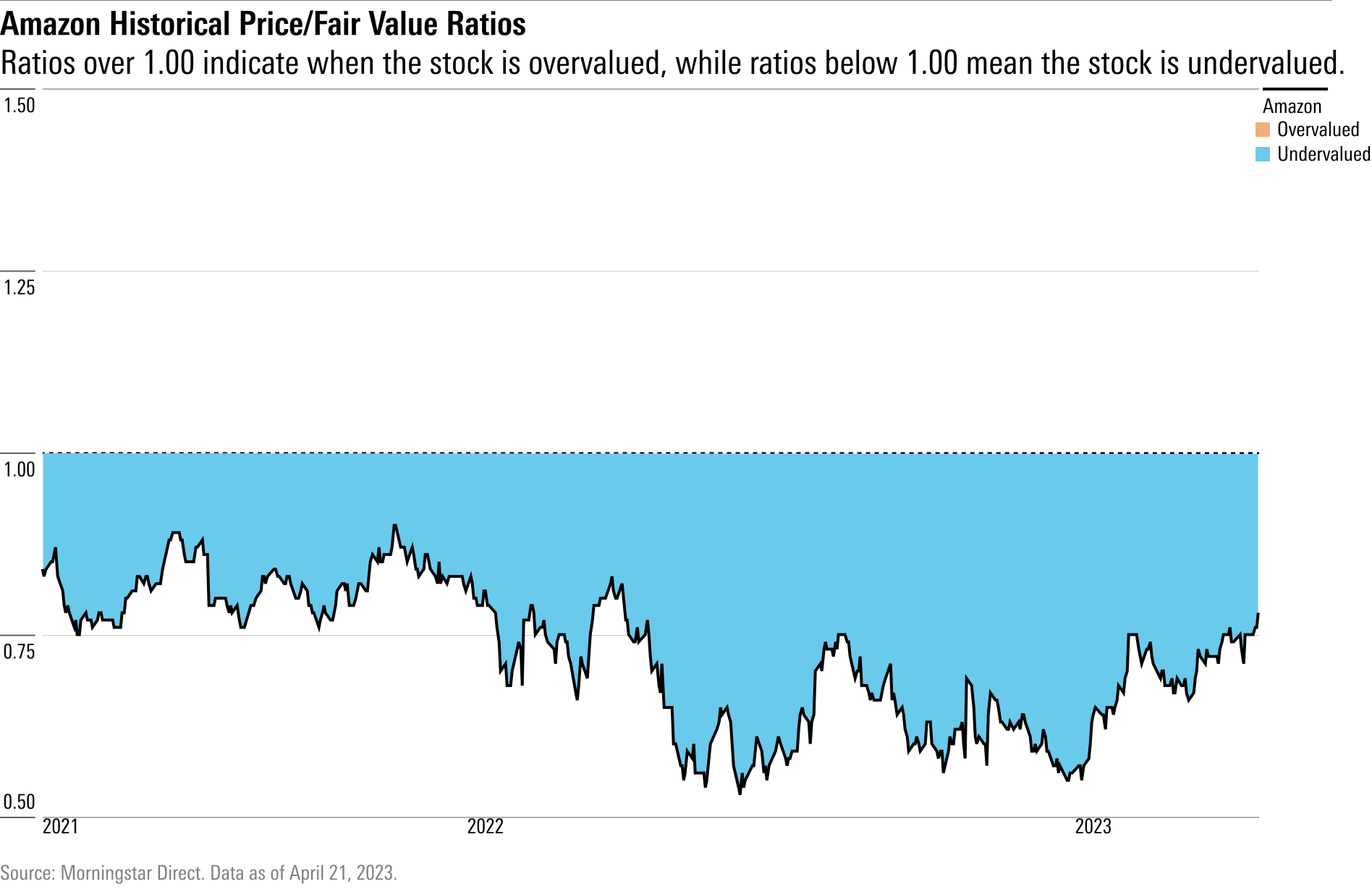

Ahead of Earnings, Is Amazon Stock a Buy? | Morningstar - Source www.morningstar.com

Amazon Stock Performance: Real-Time Value And Investment Analysis

The connection between Amazon stock performance and real-time value and investment analysis is crucial for informed decision-making in the financial markets. Amazon's stock performance serves as a key indicator of the company's financial health, growth prospects, and overall market sentiment. Real-time value and investment analysis helps investors assess Amazon's stock value and make informed decisions about buying, selling, or holding its shares.

Amazon Stock Split 2024 Price - Judye Marcile - Source collenqrobbin.pages.dev

Amazon's stock has consistently outperformed the broader market in recent years, driven by the company's strong growth in e-commerce, cloud computing, and other businesses. The company's innovative business model, vast customer base, and efficient operations have contributed to its impressive stock performance. Real-time value and investment analysis allows investors to monitor Amazon's financial performance and market sentiment in real-time, enabling them to make strategic investment decisions.

Understanding the connection between Amazon stock performance and real-time value and investment analysis is essential for successful investing. Amazon's stock performance provides valuable insights into the company's financial health and growth prospects, while real-time value and investment analysis help investors make informed investment decisions.

| Amazon Stock Performance | Real-Time Value And Investment Analysis | |

|---|---|---|

| Definition | The actual performance of Amazon's stock in the financial markets. | The process of evaluating Amazon's stock value and investment potential in real-time. |

| Importance | Provides insights into Amazon's financial health and growth prospects. | Enables investors to make informed investment decisions. |

| Methodology | Examines financial statements, analyst reports, and market data. | Uses financial models, technical analysis, and market sentiment indicators. |

| Applications | Investment decision-making, portfolio management, and risk assessment. | Trading strategies, stock valuation, and long-term investment analysis. |

Conclusion

The connection between Amazon stock performance and real-time value and investment analysis is critical for successful investing. By understanding Amazon's financial performance and monitoring market sentiment in real-time, investors can make informed decisions about buying, selling, or holding its shares. The insights gained from this analysis can help investors maximize their returns and minimize their risks.

As Amazon continues to grow and innovate, its stock performance will remain a key indicator of its success. Investors should stay informed about the latest developments and use real-time value and investment analysis to make the most of their investments in Amazon.