Ever wondered what "A Comprehensive Guide To Understanding And Paying Taxes" is all about? Wonder no more, for "A Comprehensive Guide To Understanding And Paying Taxes" is here to guide you through the complex world of taxes.

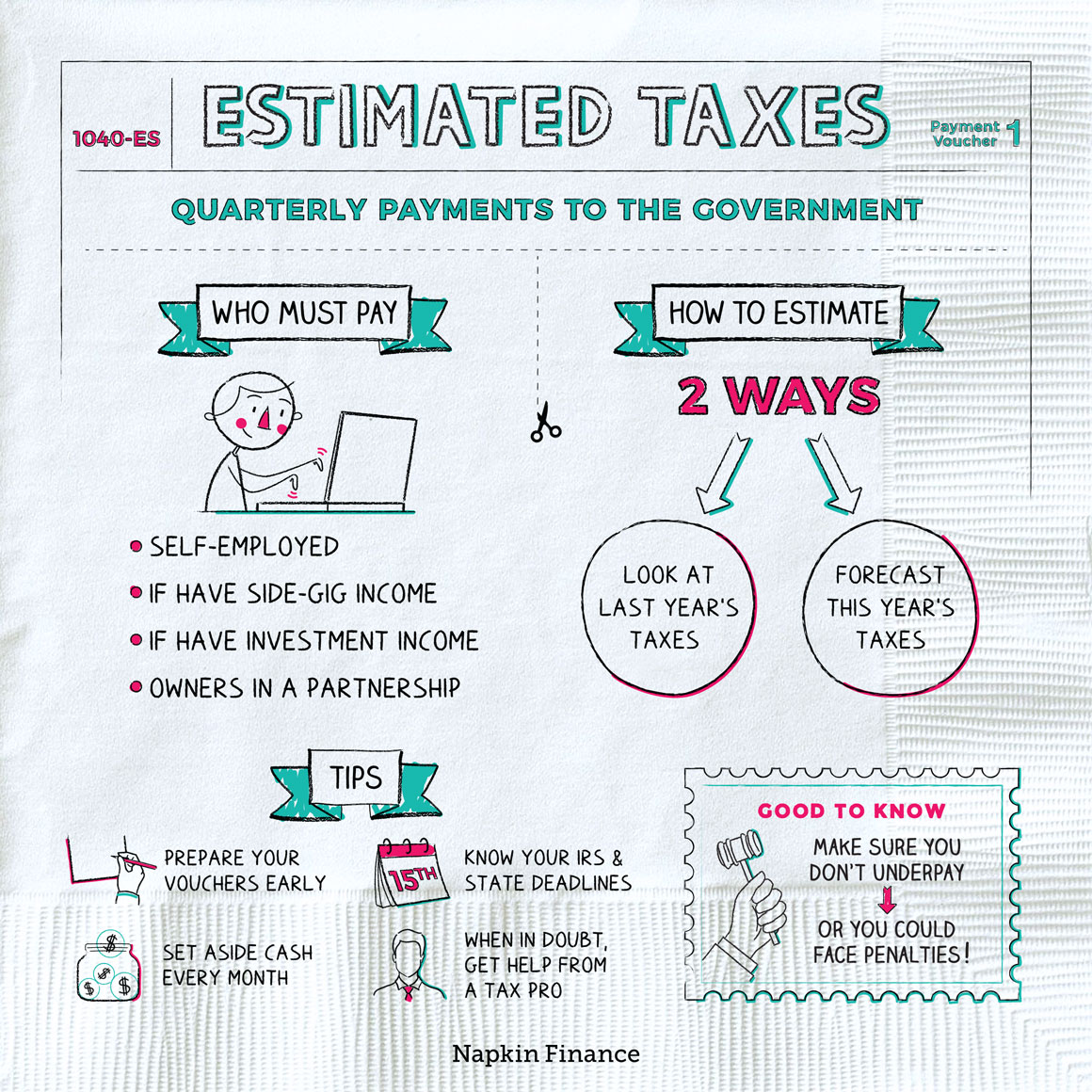

ESTIMATED TAXES – Napkin Finance - Source napkinfinance.com

Editor's Notes: "A Comprehensive Guide To Understanding And Paying Taxes" has been published today, March 8, 2023. This guide is an essential resource for anyone who wants to understand the basics of taxation and how to file their taxes correctly.

Our team has done the hard work of analyzing and summarizing the information in "A Comprehensive Guide To Understanding And Paying Taxes".

Key Differences or Key Takeaways:

Transition to main article topics:

FAQ

This comprehensive guide provides answers to frequent questions and misconceptions regarding taxes, offering a clearer understanding of the subject.

Question 1:

Why is it important to pay taxes?

Paying taxes is essential for the well-being of society. Tax revenue funds public services like education, healthcare, infrastructure, and national defense, ensuring the community's prosperity and stability.

Question 2:

What are the different types of taxes?

Tax systems vary by country, but common types include income tax, sales tax, property tax, and excise taxes on specific goods and services.

Question 3:

How can I reduce my tax liability legally?

Legitimate tax avoidance strategies include maximizing deductions, using tax credits, contributing to retirement accounts, and seeking professional tax advice to optimize one's financial situation.

Question 4:

What are the consequences of tax evasion?

Tax evasion, or intentionally failing to pay taxes, is a serious offense. Penalties can include fines, imprisonment, asset seizure, and damage to one's reputation.

Question 5:

How can I file my taxes accurately?

Thoroughly read tax instructions, gather all necessary documents, use tax software or consult with a tax professional to ensure accuracy and avoid errors or omissions.

Question 6:

What are the latest tax laws and regulations?

Tax laws are subject to change, so it's crucial to stay informed about updates and consult reliable sources like government agencies, tax professionals, or reputable financial publications.

Understanding taxes and fulfilling one's tax obligations is essential for responsible citizenship. By addressing these common questions, this guide aims to demystify the subject and empower individuals with the knowledge they need.

Proceeding to the next article section...

Tips

Navigating the complex world of taxes can be daunting, but understanding and paying them accurately is crucial for financial well-being. Here are some tips to help you master the process:

Tip 1: Get Organized

Keep meticulous records of all income and expenses. Organize receipts, invoices, and bank statements to simplify tax preparation.

Tip 2: Seek Professional Help

Consider consulting a tax professional, especially if your financial situation is complex. They can provide expert guidance and ensure your taxes are filed correctly.

Tip 3: Plan Ahead for Deductions

Familiarize yourself with eligible deductions and plan your expenses accordingly. Keeping track of charitable contributions, mortgage interest, and other deductible expenses can significantly reduce your tax liability.

Tip 4: File On Time

Meet the tax filing deadlines to avoid penalties and interest charges. Set reminders and utilize online resources to make the process seamless.

Tip 5: Understand Tax Credits

Tax credits are direct reductions from your tax bill. Learn about eligible credits and explore ways to qualify for them, such as the Child Tax Credit or Earned Income Tax Credit.

Tip 6: Pay Electronically

Paying taxes electronically through the IRS website or authorized payment services ensures timely and secure submission.

Tip 7: Maximize Retirement Savings

Contributions to retirement accounts like 401(k)s and IRAs reduce your current taxable income and provide tax-advantaged growth.

Tip 8: Stay Informed

Tax laws are subject to change. Stay updated on the latest tax reforms and regulations through reputable sources like A Comprehensive Guide To Understanding And Paying Taxes to ensure compliance and minimize your tax liability.

By following these tips, individuals can navigate the tax system with confidence, maximize deductions and credits, and fulfill their tax obligations accurately and efficiently.

A Comprehensive Guide To Understanding And Paying Taxes

Navigating the complexities of taxation requires a comprehensive understanding of its essential aspects. These include:

- Income Types: Identifying various sources of taxable income.

- Tax Brackets: Understanding progressive tax rates and their impact on income.

- Deductions and Credits: Discovering tax savings opportunities through eligible expenses and credits.

- Filing Options: Choosing between different tax filing statuses and selecting appropriate forms.

- Payment Deadlines: Meeting timely tax payment obligations to avoid penalties.

- Tax Audit: Knowing potential triggers and preparing for possible tax examinations.

Grasping these key aspects empowers taxpayers to accurately calculate their tax liability, optimize their tax savings, and fulfill their tax obligations confidently. By understanding income classification, tax brackets, and available deductions, individuals can minimize their tax burden while ensuring compliance.

Premium AI Image | Slot machine paytables and gain a comprehensive - Source www.freepik.com

A Comprehensive Guide To Understanding And Paying Taxes

The comprehensive guide on "A Comprehensive Guide To Understanding And Paying Taxes" is designed to help individuals and businesses understand and meet their tax obligations. This guide provides detailed information on tax laws, regulations, and procedures to ensure compliance and avoid potential penalties. It includes explanations of different types of taxes, tax calculations, tax deductions, and tax credits. By providing a comprehensive understanding of taxation, the guide enables individuals and businesses to make informed decisions about their financial planning and tax strategies.

Make Money by Paying More Taxes - Buy or Sell a Business | Fast Results - Source www.bizprofitpro.com

Understanding and paying taxes are crucial for individuals and businesses. Tax obligations vary depending on factors such as income, business structure, and location. Failure to comply with tax laws can result in penalties, interest charges, and legal consequences. A comprehensive guide to understanding and paying taxes provides essential information to help individuals and businesses navigate the complexities of the tax system, ensuring compliance and protecting their financial interests.

Real-life examples highlight the importance of understanding and paying taxes. Individuals who fail to file their tax returns on time may face penalties and interest charges. Businesses that incorrectly calculate their taxes may end up owing more than they anticipated, affecting their profitability. By providing a comprehensive understanding of tax laws and regulations, the guide empowers individuals and businesses to avoid such situations and manage their tax obligations effectively.

The practical significance of understanding and paying taxes extends beyond financial implications. Compliance with tax laws demonstrates responsible citizenship and contributes to the overall functioning of society. Taxes fund essential public services such as education, healthcare, and infrastructure, which benefit everyone. By understanding their tax obligations, individuals and businesses can contribute to the common good and support the well-being of their communities.

A comprehensive guide to understanding and paying taxes provides a valuable resource for individuals and businesses to navigate the complexities of the tax system. By offering clear explanations, practical examples, and expert guidance, the guide empowers individuals and businesses to make informed decisions about their tax obligations, ensuring compliance, avoiding penalties, and contributing to the overall functioning of society.

Table: Key Insights from "A Comprehensive Guide To Understanding And Paying Taxes"

| Concept | Importance |

|---|---|

| Understanding Tax Laws | Ensures compliance and avoids penalties |

| Calculating Taxes Accurately | Prevents underpayment or overpayment of taxes |

| Utilizing Deductions and Credits | Reduces tax liability and maximizes savings |

| Meeting Tax Deadlines | Avoids late fees and interest charges |

| Seeking Professional Help When Needed | Ensures accurate tax preparation and minimizes risk of errors |